The start of the year 2023 marked a new paradox for gold. It grew against the background of the strengthening U.S. dollar at the auction on January 3 and continued to rally when the USD retreated. Investors' interest in the precious metal seems so great that they stopped paying attention to the dynamics of the USD index. However, based on a couple of days, it is too early to draw conclusions because XAUUSD now has another ally—the U.S. Treasury bonds.

Economic outlook

Expectations of a recession in the United States and China's difficult exit from the zero-COVID policy increase the demand for safe-haven assets. Debt yields are falling as prices rise. Real rates are also falling with anchored inflation expectations, reducing the cost of holding gold in an ETF and helping it continue its rally towards at least $1,900 an ounce.

Dynamics of gold and U.S. bond yields

The combination of geopolitical risks remaining high, fears of an approaching global recession and a slowdown in the rate of monetary restriction by the Fed is creating a tailwind for gold. The armed conflict in Ukraine is unlikely to end in the next 6–12 months, the global economy is less firmly on its feet than in 2022, and central banks are well aware that raising rates as aggressively as last year means exacerbating the recession.

The Fed's monetary policy blocked gold's oxygen in 2022

If the Fed's monetary policy blocked gold's oxygen in 2022, it could push it to new heights in 2023. Compare that to +425 bps to the Fed Funds rate last year and the expected +75–100 bps this year. In addition, the markets continue to expect a "dovish" reversal when borrowing costs start to decline after numerous acts of raising them.

Let's not discount the potential increase in investment demand for a physical asset. The outflow of capital from ETFs has good opportunities to reverse. The increase in stocks of specialized exchange-traded funds is a "bullish" factor for XAUUSD. So is rising demand for the precious metal from central banks. In the third quarter, they increased their purchases to a record 400 tons, and they do not seem to be going to stop.

Thus, fans of gold are full of optimism. However, there are risks that things will not go according to their plan. If the U.S. labor market remains strong and inflation suddenly picks up after several months of slowdown, the dollar will rise from the ashes, damaging the precious metal's reputation. In this respect, the December employment and consumer price data releases are a test for XAUUSD. They may trigger a short-term pullback, although the upward trend is likely to remain in place.

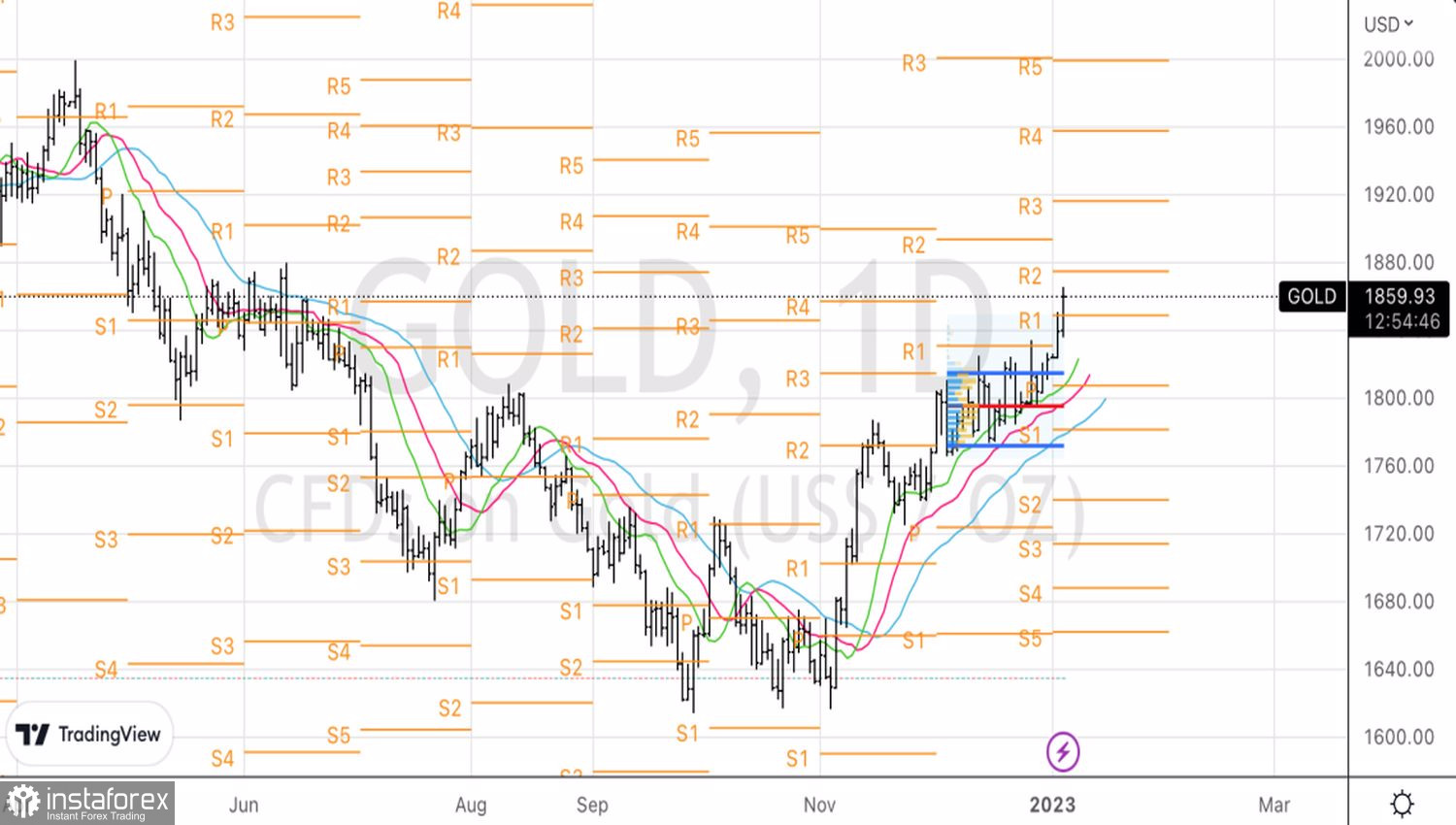

Technically, long positions formed on the rebound from the fair value of $1,795 per ounce are now paying off. At the same time, the inability of gold to overcome the $1,856 and $1,875 pivot points or its return below the support at $1,850 are the signs of "bulls' weakness and the reason for partial profit taking or reversal.

Relevance up to 10:00 2023-01-09 UTC+1 Company does not offer investment advice and the analysis performed does not guarantee results. The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](https://www.fxmag.com/media/cache/article_small_filter/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)