Concerns about US growth due to recent shortages in US PPI and retail sales cast a shadow over the dollar. The Fed's hawkish speakers are being largely shunned by the markets at this point.

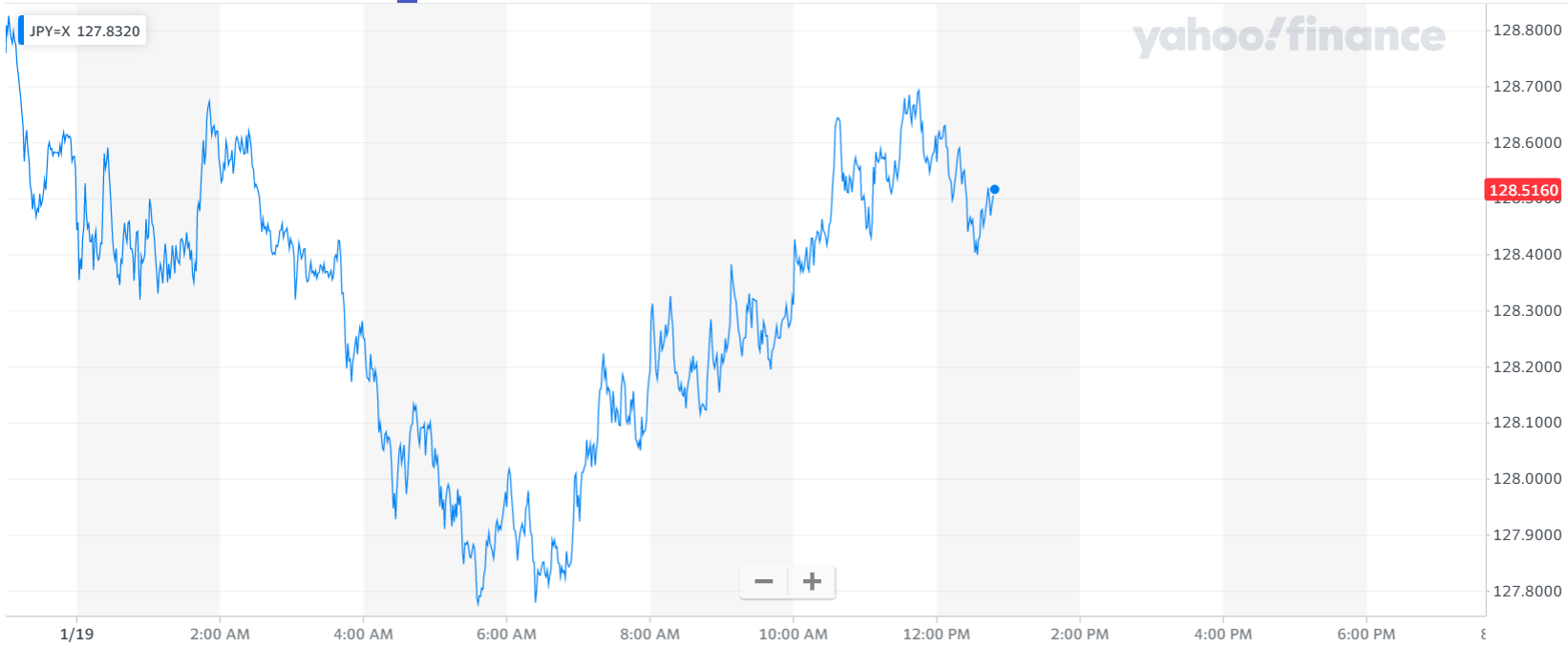

USD/JPY

The Japanese yen, long favored as a safe haven and funding currency, has become so embroiled in market speculation over central bank policy in recent weeks that Wednesday's status quo decision triggered the yen's biggest fall in nearly three years.

In a bond market where the central bank battled bond bears to defend its yield cap, the BoJ bought up so many of the issued 10-year Japanese government bonds that market liquidity virtually dried up.

Speculators focused on the yen instead.

Until late last year, BJ's dovish stance in the face of aggressive rate hikes by the Federal Reserve and other major central banks meant the yen was cheap and weak, making it an ideal currency to borrow for investment.

Today USD/JPY started the day at 128.55 but then dropped below 128. USD/JPY is now trading back at the level from the start of the day, above 128.50

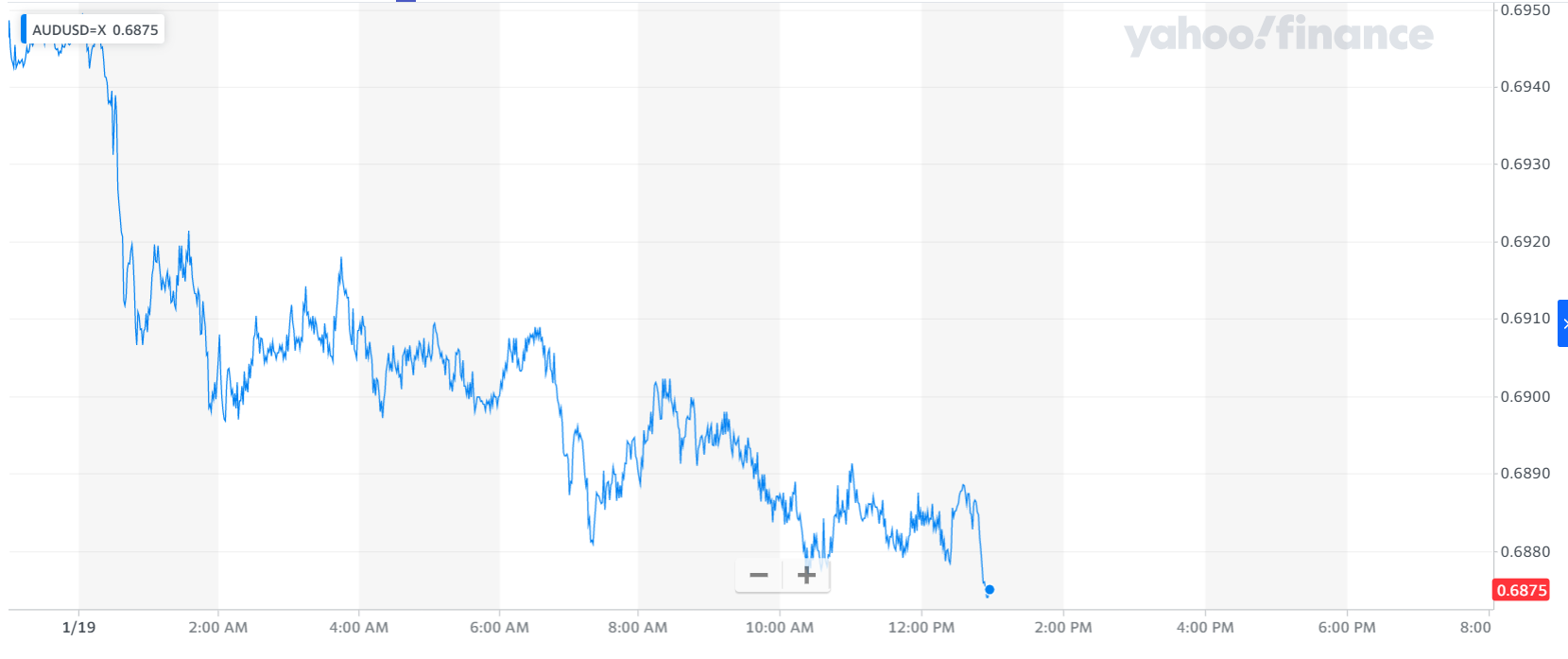

AUD/USD

The Australian dollar falls after the unemployment rate in December was 3.5% from 3.4%.

The figures show that the labor market remains robust, even as the Reserve Bank of Australia raised the cash rate by 3% from its pandemic low.

The bank has rolled back large rate hikes and the futures market has a 50-50 chance of a 25 basis point hike priced at the February 7 monetary policy meeting.

Ahead of this meeting, the key CPI data for the fourth quarter will be released on Wednesday next week, January 25. The RBA said it expects growth to 8% later this year

The AUD/USD pair extended an overnight sharp pullback from the 0.7060-0.7065 area, its highest level since Aug. 16, and remains under strong selling pressure for a second consecutive day on Thursday. The downward trajectory remains uninterrupted throughout the European session.

The Australian pair is currently trading below $0.70 but above $0.6850.

Read next: Elon Musk Is Facing Trial In Fraud Trial Over 2018 Tweets| FXMAG.COM

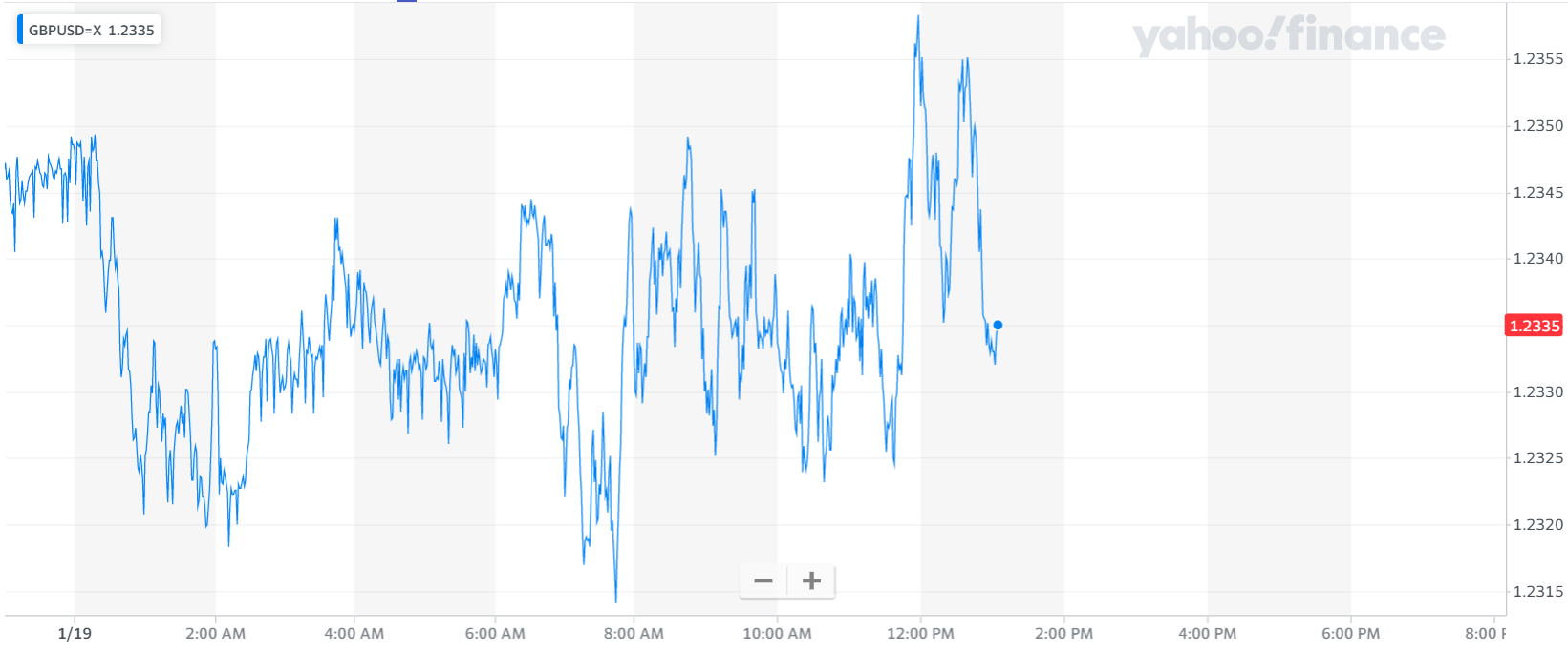

GBP/USD

GBP/USD consolidates losses below 1.2350 during Thursday's European session.

GBP/USD pair is currently above 1.2330.

On the UK front, inflationary pressures have eased, according to the December Consumer Price Index (CPI) report published on Wednesday. Headline inflation was lowered to 10.5% on an annualized basis and the core CPI, which excludes oil and food prices, remained stable at 6.3%. The magnitude of the drop in the inflation rate is not enough to convince market participants that inflation in the UK is falling in a promising way.

Therefore, investors should prepare for the continuation of the extremely hawkish monetary policy of the Bank of England (BoE). The UK data schedule is empty on Thursday, however, and traders will have to content themselves with looking ahead until Friday, when consumer confidence figures for January and retail sales figures for December are released. Consumers are expected to be a little less optimistic than they were.

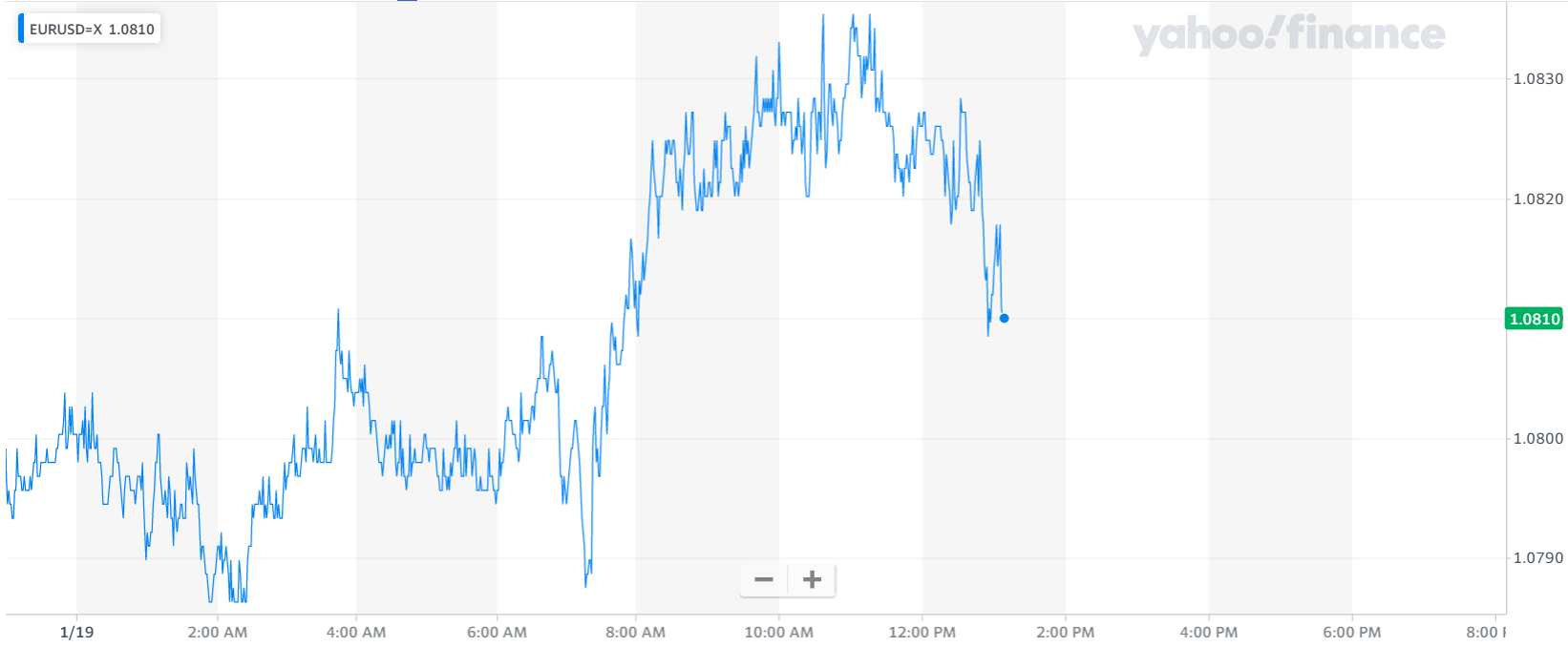

EUR/USD

European Central Bank (ECB) President Christine Lagarde's speech on Thursday will point investors to the likely monetary policy actions in February. Falling energy prices in the euro area have moderated inflation, but the current rate of inflation is still far from the median. Therefore, investors should prepare for a hawkish comment by Lagarde from the European Central Bank.

European Central Bank (ECB) policymaker Francois Villeroy de Galhau said on Wednesday it was "too early to speculate what we will do in March". However, he believes that Lagarde's earlier forecast of 50 bp is still valid.

EUR/USD holds gains above 1.0800 in European trading. The pair is supported by falling US Treasury yields.

Source: investing.com, finance.yahoo.com

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](https://www.fxmag.com/media/cache/article_small_filter/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)