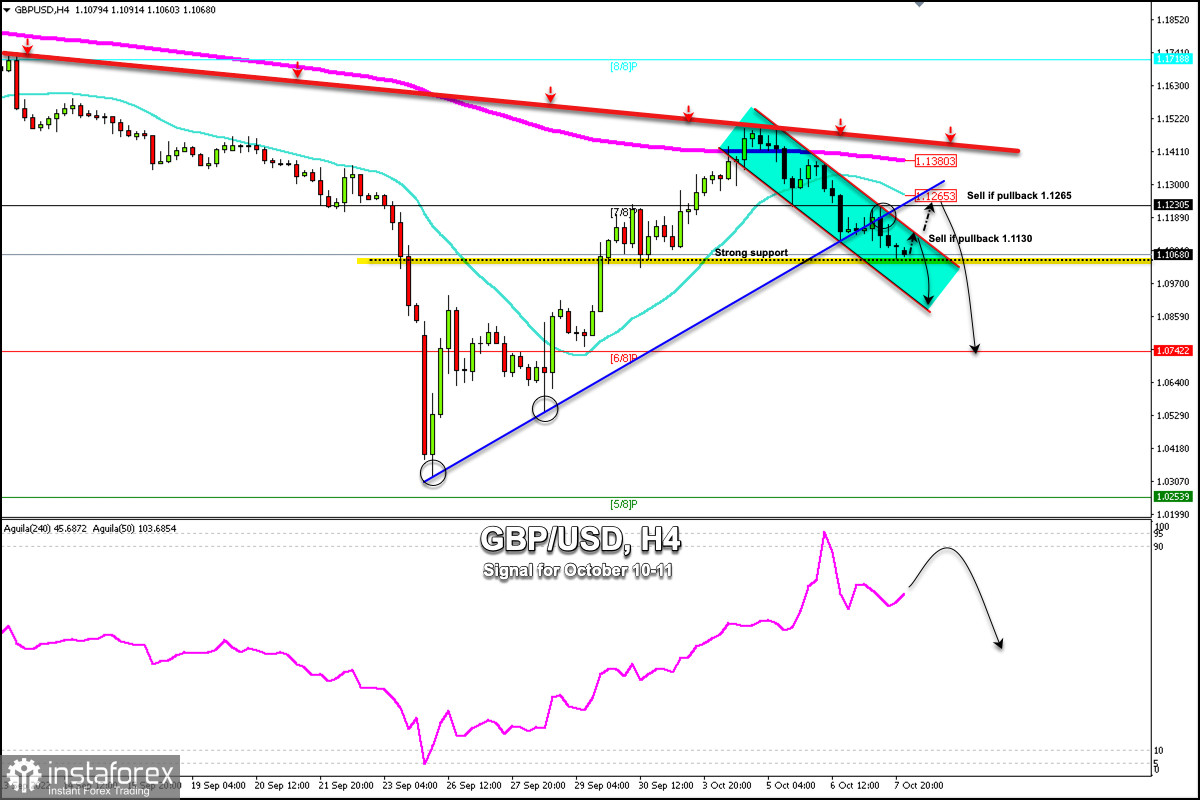

Early in the European session, the British pound (GBP/USD) is trading at around 1.1068, bouncing above strong support at 1.1060. The pair is expected to recover in the next few hours and it may reach the top of the downtrend channel formed on September 30.

In case the British pound fails to break out of the downtrend channel, it is likely to resume its bearish cycle. GBP/USD could fall towards the critical support at 1.1060 and could beat and fall towards the bottom of the downtrend channel around 1.0850.

On the other hand, a sharp break of the secondary downtrend channel could continue to rise and the instrument could reach the 21 SMA and 7/8 Murray zone located around 1.1230 - 1.1265.

The uptrend channel formed on September 23 crosses around 1.1270. A pullback to this area and could be a good sign to sell GBP. The currency pair could fall in the next few days towards 6/8 Murray located at 1.0742.

In the medium term, as long as GBP/USD consolidates below the psychological level of 1.15 and below the 200 EMA located at 1.1380, the British pound will remain under bearish pressure.

Any attempts to break the area of 1.14 and a failure to consolidate above it will be seen as a selling opportunity. It is likely that in the medium term the British pound could fall towards 5/8 Murray at 1.0253.

Short-term technical indicators support a bearish continuation. On October 5, the eagle indicator reached the extremely overbought zone. For now, we can see a bullish signal but it could again show overbought signs and GBP/USD could resume the main bearish movement.

Relevance up to 06:00 2022-10-15 UTC+2 Company does not offer investment advice and the analysis performed does not guarantee results. The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](https://www.fxmag.com/media/cache/article_small_filter/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)