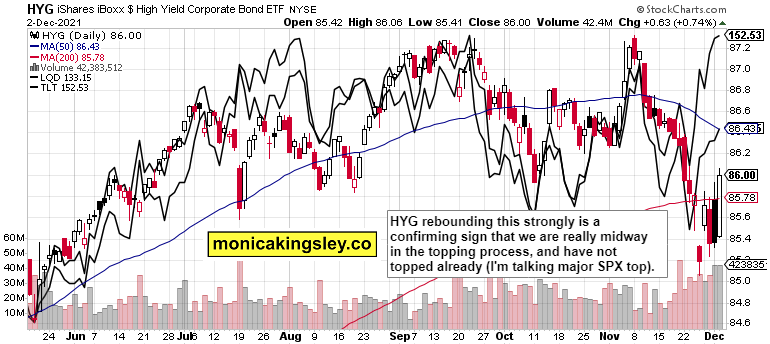

S&P 500 sharply rebounded, and signs are it has legs. My key risk-on indicator to watch yesterday, HYG, turned up really strongly. No problem that the dollar didn‘t decline, it‘s enough that financials and energy caught some breath. We‘re turning to risk-on as Omicron didn‘t cause the sky to fall. What a relief! Seriously, it doesn‘t look that hard lockdowns would be employed, which means the market bulls can probe to go higher again.

What I told you on Wednesday already in the title It‘s the Fed, Not Omicron, today‘s non-farm payrolls illustrate. Such was the game plan before the data release, and this refrain of bad is the new good, is what followed. The Fed is desperately behind the curve in taming inflation, and its late acknowledgment thereof, doesn‘t change the bleak prospects of tapering (let alone accelerated one) into a sputtering economy. What we‘re experiencing currently in the stock market, is a mere preview of trouble to strike in 2022.

We‘re in the topping process, and HYG holds the key as stated yesterday.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

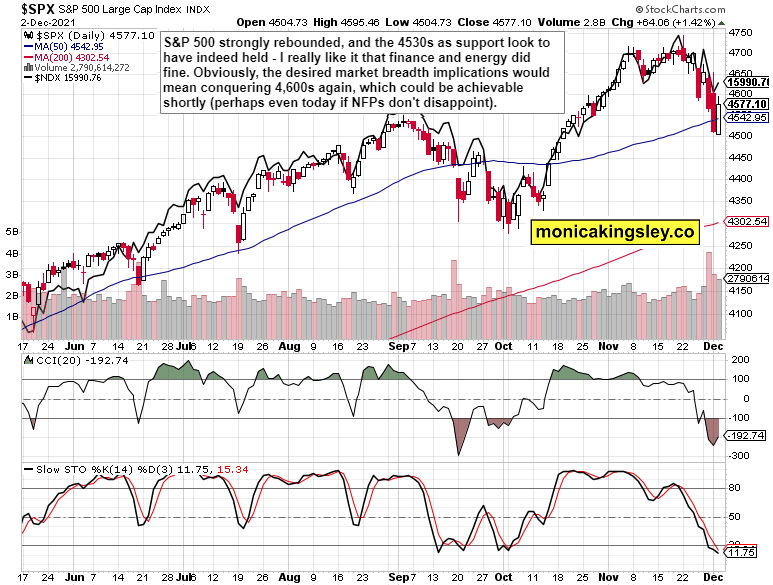

S&P 500 and Nasdaq Outlook

S&P 500 returned above the 50-day moving average, the volume wasn‘t suspicious – the bulls have regained the benefit of the doubt, and need to extend gains convincingly and sectorally broadly next.

Credit Markets

HYG successfully defending gained ground, would be a key signal of strength returning to risk-on assets and lifting up S&P 500. There is still much to go – remember that the sharpest rallies happen in bear markets, so all eyes on HYG proving us either way.

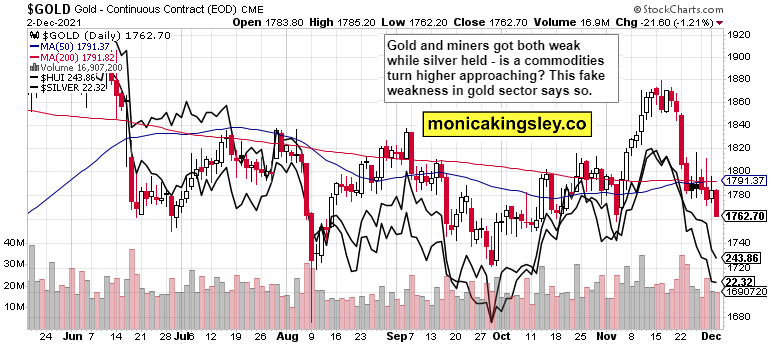

Gold, Silver and Miners

Precious metals weakness looks deceptive and prone to reversal to me – the real fireworks though still have to wait till the Fed gets doubted with bets placed against its narratives.

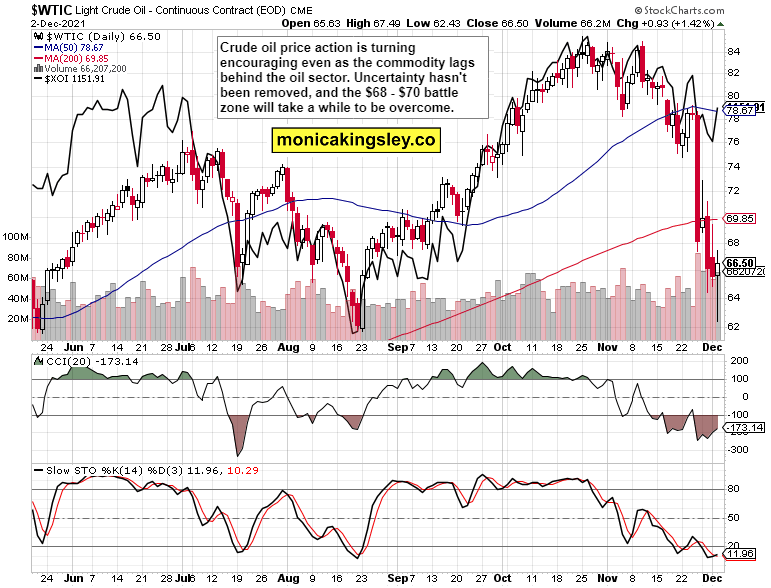

Crude Oil

Crude oil plunge is getting slowly reversed, about to. Beaten down the most lately, black gold is readying an upside surprise.

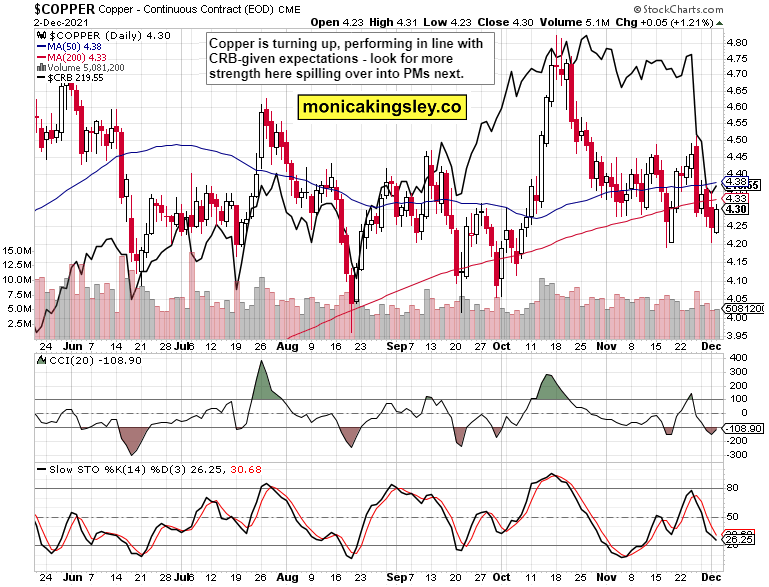

Copper

Copper is turning higher, taking time, but turning up – it‘s positive, but still more of paring back recent setback than leading higher. I‘m reasonably optimistic, and acknowledge much time is needed to reach fresh highs.

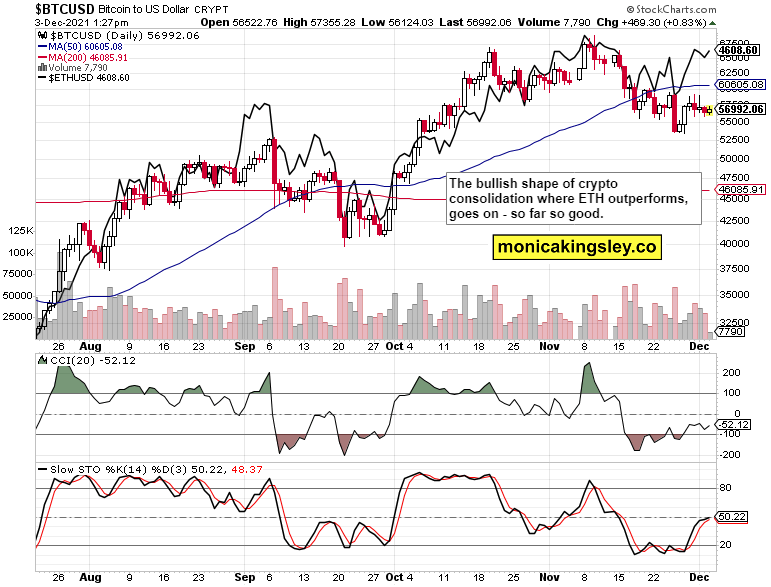

Bitcoin and Ethereum

The bearish ambush of Bitcoin and Ethereum didn‘t get too far – crypto consolidation goes on, no need to panic or get excited yet.

Summary

- S&P 500 is in a recovery mode, and the bulls look ready to prove themselves. The keenly watched HYG close presaged the odds broadly tipping the risk-on way, just as much as cyclicals did. It‘s a good omen that commodities are reacting – not too hot, not too cold – with precious metals in tow. In tow, as the Fed isn‘t yet being doubted – the NFPs are a first swallow of its inability to carry out tapering plans till the (accelerated or not) end.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](https://www.fxmag.com/media/cache/article_small_filter/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)