While bitcoin and ether are rapidly falling and returning to their annual lows to break through and collapse even lower, South Korean prosecutors are trying to freeze 3,313 bitcoins on two cryptocurrency exchanges, allegedly associated with the founder of Luna, Do Kwon.

The coins were moved shortly after a South Korean court issued an arrest warrant for the Terraform Labs co-founder.

It is reported that the South Korean authorities have asked several cryptocurrency exchanges to freeze 3,313 bitcoins allegedly associated with the co-founder of Terraform Labs. The coins were transferred to trading platforms shortly after a warrant for Kwon's arrest was issued in South Korea.

Yesterday, a representative of the Prosecutor's Office of the Southern District of Seoul said they have evidence that 3,313 BTC belongs to Kwon. The coins were transferred to trading platforms from a wallet allegedly linked to the Luna Foundation Guard (LFG), which was created on September 15. Cryptoquant, the company that handled the investigation, said that the new bitcoin addresses belong to LFG. This conclusion was made based on transaction patterns, related flows, and significant non-public information.

By yesterday evening, the Luna foundation rejected the involvement of this cryptocurrency. On Twitter, the company published the bitcoin address of its wallet, adding that LFG has not created any new wallets and has not moved BTC or other tokens that it owns since May 2022.

Meanwhile, the location of the founder of Luna is unknown, and he no longer gets in touch. He was believed to be in Singapore, but earlier this month, Singapore police said he was currently out of town. Back on Monday, Kwon tweeted that he was not on the run.

Let me remind you that on September 14, a South Korean court issued an arrest warrant for Kwon. He is accused of fraud after the collapse of the Luna cryptocurrency. In addition, it is reported that the Ministry of Foreign Affairs of the country plans to cancel his passport. Yesterday it became known that Interpol had put the co-founder of Terraform Labs, Do Kwon, on the wanted list. The "red notice" that has been issued allows South Korea to receive assistance from law enforcement agencies around the world in finding and arresting a person awaiting extradition, extradition, or similar judicial action.

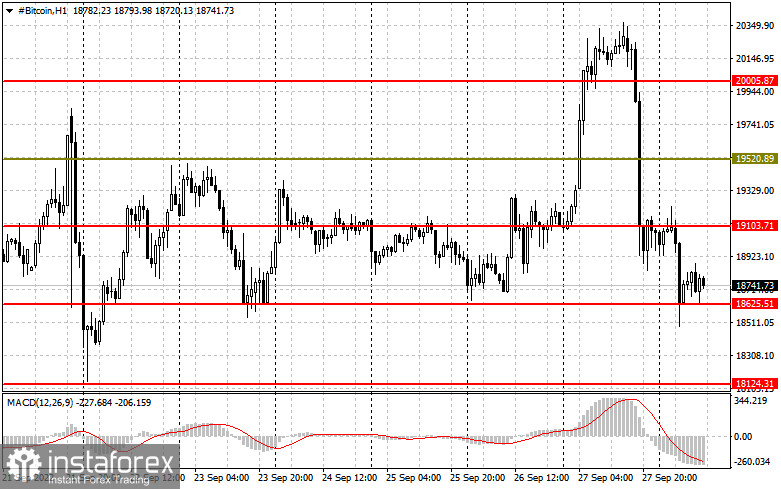

As for today's technical picture of bitcoin, as I noted above, the failure of the trading instrument and the return to the framework of the side channel took place quite quickly. This indicates that investors have no interest in risks. The focus is now on the $19,000 resistance, the return of which is necessary to build a new upward correction in the pair. In the case of a breakthrough in this area, you can see a dash up to $19,520 and into the $20,000 area. To build a larger uptrend, you need to break above the resistances: $20,540 and $21,410. If the pressure on bitcoin increases and all the prerequisites for this, the bulls should make every effort to protect the support of $18,625, just above which trading is now underway. Its breakdown will quickly push the trading instrument back to the lower border of the $18,100 side channel and pave the way for an update of the $17,580 level.

Ether has again failed to reach the significant support of $ 1,275, and now there is a risk of building a new bear market. A breakdown of $1,275 can lead to significant changes in the market. Only a fix above $1,343 will somehow calm the situation and return the balance to the ether. Consolidation above $1,343 will stabilize the market direction and push the ether to another correction in the area of $1,402 and $1,457. The further targets will be the areas: $1,504 and $1,550. If the pressure on the trading instrument remains and at the breakdown of $1,275, we can see a new movement of the trading instrument down to the support of $1,210. Its breakdown will push the ether to $ 1,150, where major players will manifest themselves in the market again.

Relevance up to 10:00 2022-09-29 UTC+2 Company does not offer investment advice and the analysis performed does not guarantee results. The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](https://www.fxmag.com/media/cache/article_small_filter/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)