Rates Spark: A last one for the road

A hike from the ECB today may have limited impact as a total of 25bp of tightening is already fully priced before year-end. Signalling will be at least equally important, with macro headwinds weighing on longer rates.

ECB may hike, but the upside to rates looks limited

The European Central Bank meeting takes centre stage today. Going into the pre-meeting blackout period, surveys pointed to an almost even split between analyst calls for a pause and those for a hike. We think the ECB’s hawks will have their way today, pushing through one final hike, but it is a close call.

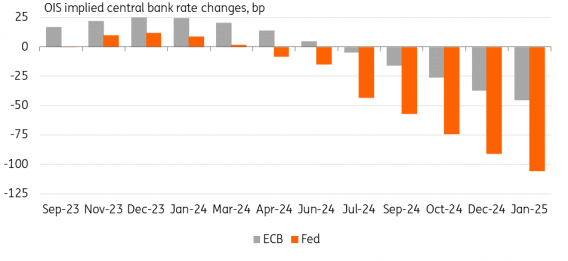

From the market’s perspective, the probability of a hike has increased from 40% at the start of the week to now more than 60%, with 16bp priced in the OIS forward. A Reuters source story had tipped the balance, reporting that the ECB’s new inflation forecast for 2024 would come in above the 3% that had been pencilled in at the last update in June.

The upside to rates from a hike today could be limited though. For one, we have seen the yield curve already bear flattening quite a bit as an increasing probability for a final hike was baked into the front end – looking beyond today towards year-end, 25bp is now fully priced. Raising rates today would probably be largely interpreted as pulling forward that final hike, but the appetite to price in more tightening on top of that may be limited. After all the subdued macro story is not going away, and with a likely downgrade of the ECB’s own growth projection the weaker backdrop should gain more weight in the governing council’s own deliberations as well.

Markets could sense that this is the end of the interest rate hike cycle. Still, the ECB will likely want to counter the notion that this is the end of its overall inflation-fighting endeavours. We think the degree to which this is successful will determine how much of a curve bear flattening we get in the case of a hike. A renewed focus on quantitative tightening could help prop up longer rates on a relative basis.

Now or later? 25bp from the ECB is already fully priced by year-end

US CPI release leaves the bigger picture unchanged

The US CPI data yesterday included a modest surprise in the month-on-month core print, which edged up to 0.3% from 0.2%. If anything, one would suspect that this underscores lingering inflation concerns. AAs our economists write, it should mean that the Federal Reserve will keep a final hike in their forecasts even while holding rates next week.

The market reaction suggests that investors were braced for a larger hawkish surprise out of the data. In the end, the data being broadly in line with the consensus call can explain the relief rally that followed. It saw the 2Y UST slipping below 5% again with the curve bull steepening somewhat in the process, although price action here was quite choppy over the session.

While some hawkish tail risks may thus have been priced out, it does not change the story that the economy is so far proving relatively resilient in the face of the overall substantial Fed tightening. Until we see activity actually stalling we think this still means more persistent disinversion pressure on the US curve from the back end, with a structural US supply story adding to the theme.

Today's events and market view

The main focus will be the ECB decision and then the press conference in the afternoon, but we have a feeling that the usual post-meeting background reporting will also get more attention this time, given the closeness of the decision and the growing divides in the governing council.

While we do see a chance for more curve flattening out of the ECB event, there is also a busy slate of US data to digest. Foremost will be US retail sales data for August, where the market is already positioned for a weaker figure after a higher July reading. At the same time we will also get PPI as well as initial jobless claims data

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](https://www.fxmag.com/media/cache/article_small_filter/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)