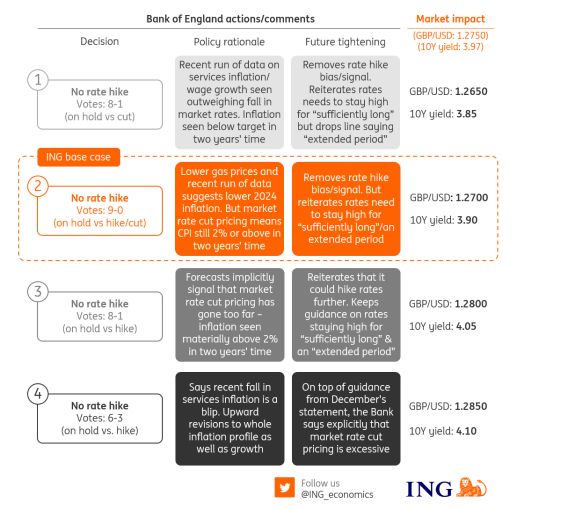

Four scenarios for the Bank of England's February meeting

Expect the BoE to drop the pretence that it could hike rates again but to continue signalling rates will stay restrictive for an "extended period". With services inflation and wage growth to remain sticky in the near term, we think August is the most likely starting point for rate cuts.

Four scenarios for the Bank of England meeting

The BoE seems more reticent than other central banks to endorse rate cuts

Both the Federal Reserve and European Central Bank have hinted, with varying degrees of caveats, that rate cuts are on the cards this year. So far, the Bank of England hasn’t followed suit. It was careful not to say anything at the December meeting that could be misconstrued as an endorsement of market pricing on cuts. And there has essentially been radio silence from committee members since then.

We suspect the Bank will still want to tread carefully as it gears up for the first meeting of 2024. But the reality is that defending a “higher for longer” stance on interest rates is getting harder as the inflation backdrop shows signs of improving. Remember that the BoE has pinned the chances of rate cuts on three variables. One is the strength of the jobs market, but data here is suffering from well-known reliability problems. So, in practice, it comes down to services inflation and private-sector wage growth. Both are tracking well below the November BoE projections.

Services CPI is currently 6.4%, and despite that coming as an upside surprise to consensus when it was released, it’s still half a percentage point below the BoE’s projection. Private wage growth is 6.5%, but remember this is a three-month average and the latest two ‘single month’ readings are around 6%. When we get the data in a couple of weeks, this variable is likely to have ended the year a full percentage point below the BoE’s most recent forecast (7.2%).

Add in the fact that natural gas prices are noticeably lower across the futures curve, and we should see sizeable downward revisions to the Bank’s inflation forecasts for this year. But what happens to the forecasts beyond 2024 is less clear-cut.

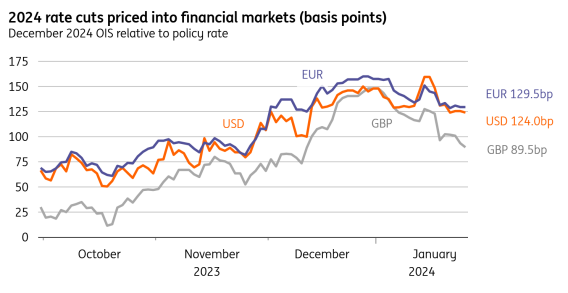

Financial markets expect roughly four UK rate cuts this year

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](https://www.fxmag.com/media/cache/article_small_filter/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)