Our view on EU construction markets

Germany: Four years of contracting building volumes

In the first half of this year, German construction activity declined by 1.4% year-on-year after a decline in 2022 of 1.6%. For 2023, we forecast a moderate contraction of the largest construction market in the EU. The building industry continues to suffer under higher interest rates and increased construction costs, which led to three German project developers – Project Immobilien, Development Partner and Euroboden – filing for bankruptcy in August.

Order book assessment of contractors also declined to 3.8 months in the third quarter of 2023 from 4.3 months a year earlier. A sharp decline in building permits for new residential buildings in the first half of this year also signals a further decrease still to come. Along with higher interest rates and construction costs, policy uncertainty regarding sustainability measures in the real estate sector added to the drop in the number of new permits.

Spain: Construction sector at a turning point

By the end of 2022, the production level was almost 25% lower than it was at the end of 2019. Yet, order books are now improving and the EU's recovery fund investments in the Spanish construction sector should generate a more positive outcome moving forward. The increase in permits will also have a positive effect on building volumes – although the question will remain as to how many approved projects will actually be built as challenging circumstances persist. Nevertheless, we have upgraded our forecast for Spain.

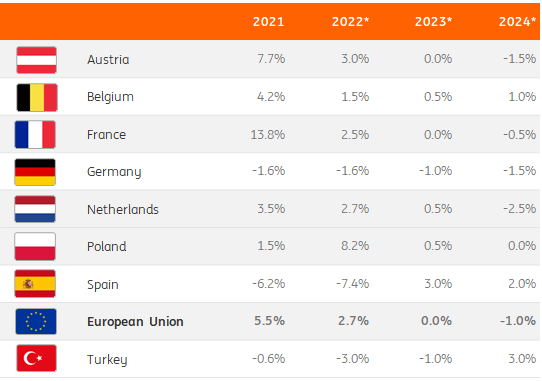

EU construction forecast

Volume output construction sector, % YoY

The Netherlands: Construction faces sharp decline in 2024

We expect Dutch construction volumes to experience a slight growth of 0.5% this year. A small contraction was previously anticipated, but unexpectedly high growth in the first quarter of this year has led to the possibility of ending 2023 with a small increase. Signs of cooling are already evident at the beginning of the Dutch construction value chain, with a visible contraction in project development and the production of building materials such as concrete, cement, and bricks. This trend will continue further down the supply chain. As a result, we expect a contraction of 2.5% in Dutch construction output next year – the largest decline since 2013. This is a relatively large drop compared to other countries. However, the Dutch building sector has performed well in recent years, and production levels should therefore remain at high levels.

Belgium: Low growth for the construction sector in 2023

Belgian construction output rose by 0.3% in the first half of 2023. The Belgian construction confidence index has been hovering around a neutral level for months but reached its lowest point of -5.0 in more than two years in July, despite an increase in building production volumes in 2022. The issuance of building permits for both residential and non-residential buildings has decreased over the same period, but more moderately than in other countries. The government's stimulus plans include funding to improve the energy efficiency of existing buildings and funds to rebuild 38,000 homes damaged by the floods in 2021. Overall, we predict that the Belgian construction sector will still experience a low growth rate of around 0.5% in 2023 and 1% in 2024.

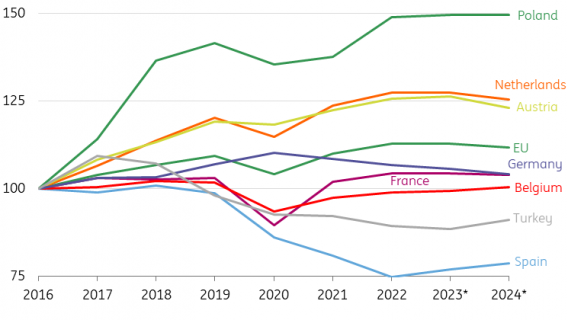

Strong development differences among countries

Development volume construction sector (Index 2016=100)

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](https://www.fxmag.com/media/cache/article_small_filter/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)