Peso positives remain in place

Physically it looks like the majority of this hedge unwind will hit the USD/MXN market in September. However, the hedge unwind does nothing to reduce one of the key driving factors of peso strength this year – which is the risk-adjusted carry. Even Banxico in its meeting minutes highlights how the risk-adjusted yield is the dominant force in driving the peso.

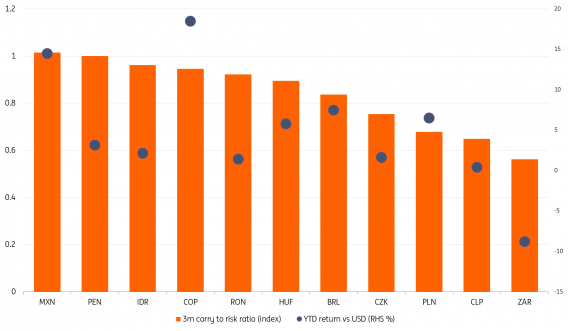

As we highlight below, the peso offers the higher carry-to-risk ratio in the EM space. This is the nominal implied yield available through the deliverable/non-deliverable FX forward market, adjusted by implied volatility from the FX options market. Unless Banxico plans to slash nominal rates or engineer some local factor that would command significantly higher implied volatility for USD/MXN, then this carry-to-risk ratio will remain a major boon to the peso.

EM currencies 'carry-to-risk' ratio and YTD performance versus USD

On the subject of potential rate cuts, it was noticeable that the Mexican TIIE swap curve barely budged on this announcement. If the FX market thinks Banxico may potentially even want to cut rates to put a floor under USD/MXN, the rates market is not buying the story. And Banxico this week has, in fact, said it will not be rushed into early rate cuts. Recall that Banxico had kept policy rates 600bp+ over the Fed to keep USD/MXN stable. We would be more worried for the peso if Banxico did threaten large, early rate cuts.

New FX policies from central banks?

We tend to view this as more a commercial and financial stability-led decision from Banxico rather than a formal red flag to further peso strength. As an aside, Brazil’s central bank – the BCB – has a $100bn short USD/BRL position through the FX forwards following intervention and probably would not go near unwinding it for fear of crashing the Brazilian real. Chile’s central bank happens to be buying FX at the moment – but that looks a function of financial stability as it tries to rebuild FX reserves after losing half of them last year.

In short, we do not think Banxico’s move is part of an effort to cap the strength in Latin currencies. Instead, we think Mexico’s high carry, decent growth, strong sovereign position and positioning for geo-political nearshoring should mean strong demand for the peso on any weakness this month.

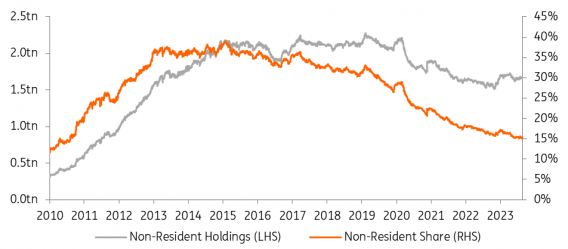

Additionally, foreign positioning in Mexcio’s local currency MBONO bond market is not particularly extreme; Mexico should be well positioned to receive funds when bond markets eventually come back into favour given its large 10% weight in the JPM GBI-EM local currency bond index.

We currently forecast USD/MXN trading down through 16.50 next year when the broad dollar turns lower on a larger-than-expected Fed easing cycle. We do not think this Banxico announcement necessitates a forecast change, and the peso will comfortably outperform its steep forward curve.

Non-resident holdings of Mexican government securities

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](https://www.fxmag.com/media/cache/article_small_filter/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)