Southern Europe to feel the most lingering pain this year from ECB rate hikes

The impact of last year's ECB rate hikes is set to have a bigger impact on southern than northern eurozone countries in 2024, according to our research. Asset prices and investments in the south have outperformed those in the north. But rapidly declining borrowing now suggests that that's about to change, not least because debt is rising rapidly

Southern eurozone countries have largely defied the impact of ECB rate hikes up to now

While expectations initially were that southern European countries would face significant problems if the European Central Bank were to raise rates aggressively, this has yet to materialise. In fact, it seems to be the other way around: several indicators point to a stronger transmission of tighter monetary policy on northern and not southern European countries.

Take the stock market, where performances in northern European main indices have been weaker than in the south. The Euro Stoxx 50 turned down in December 2021 as long-term yields started to increase globally. Since then, the German and French main indices have been up 5%, and the Dutch AEX is down 1.4%. But in Spain, Italy, Greece, and Portugal, the main indices have surged by 16, 11, 45, and 15%.

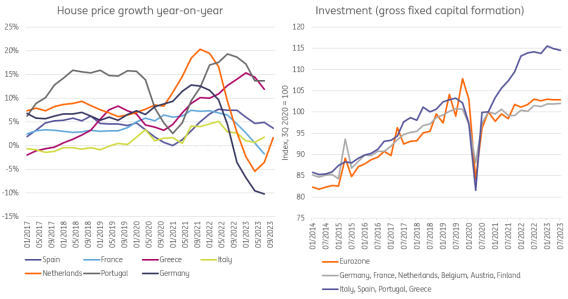

Price developments in the housing market also point to a larger impact in northern Europe. Germany, Netherlands and France have seen house prices fall below their recent highs, while Italy, Spain, Portugal and Greece still experience increasing house prices, according to the latest available data.

The surge in investments in Southern European countries is remarkable. Admittedly, there is more to investment than just interest rates; think of the impact of the Recovery and Resilience Fund and possibly the delayed impact of low interest rates and the search for yield, as well as successful structural reforms. Still, investments in Southern European countries increased by some 15% since late 2020, while investments in core countries increased by less than 5% in the same period.

We think a change is on the cards.

Investment and house prices have outperformed in southern Europe

Differences in transmission are starting to show

As we argued in this recent piece, the pain of monetary tightening is likely to be felt more in 2024 than last year due to the long and variable legs of monetary policy transmission. It just takes a while before the impact of tightening really impacts the economy. There is increasing evidence that the transmission of monetary policy in 2024 will be less favourable for southern European economies.

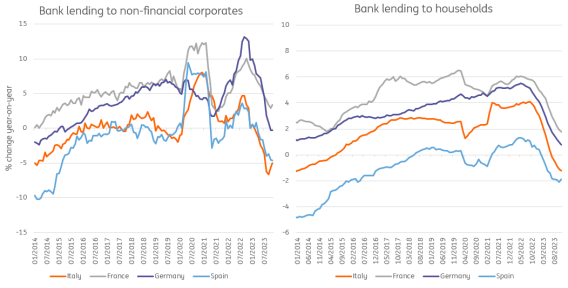

Take the most recent lending data. Lending volumes are currently falling in most southern European economies. In Italy, it's looking really rather serious as the 6% year-on-year fall of borrowing by non-financial corporates is worse than during the Global Financial and euro crises. Spain, Portugal and Italy see declining borrowing volumes for both households and corporates, while northern European economies are still seeing year-on-year growth in borrowing. Belgium and France do particularly well among larger markets, while Germany and Netherlands see stagnation. The differences in lending do not stem from differences in bank rates for new loans, as these don’t diverge materially.

Bank lending growth is diverging quickly, likely resulting in weaker periphery investment

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](https://www.fxmag.com/media/cache/article_small_filter/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)