Monitoring Hungary: Disinflation shifts into a higher gear

In our latest update, we reassess our economic and market forecasts for Hungary, as we expect disinflation to shift into a higher gear due to a marked collapse in domestic demand. In contrast, we see the technical recession ending in the second quarter, while the monetary normalisation will continue unabated if market stability prevails.

Hungary: at a glance

- Economic activity has slowed significantly in all sectors, except one. The positive contribution of agriculture will lift the economy out of the technical recession in the second quarter of 2023.

- However, unsurprisingly, the lack of domestic demand is weighing on both retail sales and industrial output, with the latter currently being supported only by export sales.

- Real wage growth has been negative for nine months, but we expect to see a turnaround as early as September, as the disinflationary process picks up speed.

- Weakening economic activity lowers import demand, which combined with lower energy prices is helping the country’s external balances to improve faster than expected.

- The rapid deterioration in the pricing power of businesses has contributed to the strengthening disinflationary process, which we expect to markedly accelerate, especially in food items.

- The normalisation cycle of monetary policy should continue unabated in 100bp steps until the September merger. Beyond that, we expect a pause and then further 100bp cuts.

- Currently we see a 0.5-1.0% of GDP slippage in this year’s budget, but a revision by the Ministry of Finance will only come in September.

- We still believe in a turnaround in forint due to FX carry and support by the improving current account and a better gas price story.

- We see the market underestimating further normalisation in the next year or two, opening the door for more curve steepening.

Technical recession will end in the second quarter, but no change to full-year outlook

Hungary has been in a technical recession for three quarters (3Q22-1Q23) as sky-high inflation has stifled economic activity. Consumption has slowed markedly, and investments have come to a standstill due to high interest rates and fiscal savings.

While most sectors continue to struggle with weak domestic demand, agriculture stands out. This is due to a combination of base effects and favourable weather conditions. In our view, these factors will lead to a significant positive contribution from agriculture to overall growth, lifting the economy out of the technical recession in the second quarter.

As we expect domestic demand to remain subdued for the rest of the year, we believe that agriculture could be the only silver lining for growth prospects this year. However, we maintain our full-year GDP growth forecast of 0.2% as we await the official second-quarter data.

Real GDP (% YoY) and contributions (ppt)

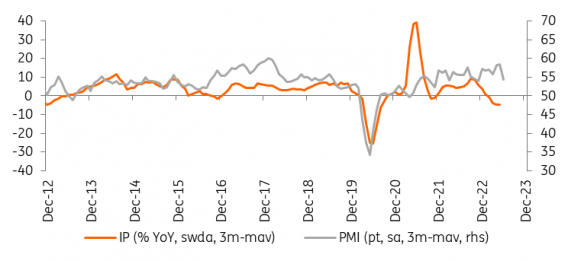

Industrial performance hinges on export activity

Industrial production surprised on the upside in May, as production volumes rose by 1.6% month-on-month but fell by 4.6% year-on-year. At a sectoral level, the picture remains unchanged, with volumes expanding only in the electrical equipment and transport equipment sub-sectors (e.g. electrical vehicle batteries and cars).

We believe this trend underlines our view that only those sub-sectors that are linked to the automotive sector, and thus largely dependent on export sales, are performing well. Nevertheless, the heavy reliance on export sales is understandable in the context of subdued domestic demand. However, with global leading indicators suggesting that recessionary forces are building globally, this could weaken export prospects and thus delay the turnaround in overall output growth in industry until next year.

Industrial production (IP) and Purchasing Managers' Index (PMI)

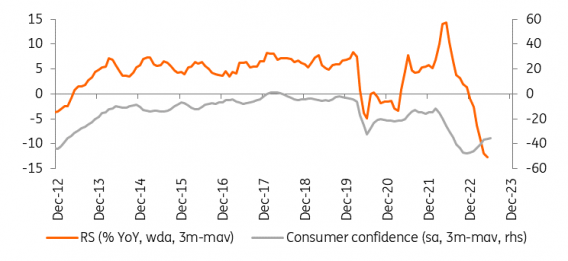

Retail sales continue to plunge as real wages deteriorate

The retail sector continues to suffer from the cost-of-living crisis, as the volume of sales in May fell by 12.3% YoY, adjusted for calendar effects. Short-term dynamics further cloud the picture, as retail sales volume fell by 0.8% MoM, with no recovery in sight. At the component level, food retailing was virtually flat, while non-food retailing fell slightly on a monthly basis. However, the lack of domestic demand is most evident in the case of fuel, as the volume of fuel retailing fell despite lowering fuel prices.

In our view, this phenomenon underlines our view that the deterioration in household purchasing power is having a significant negative impact on retail sales. In this respect, we expect this downward trend to continue at least until real wage growth turns positive, which we expect to happen as early as September.

Retail sales (RS) and consumer confidence

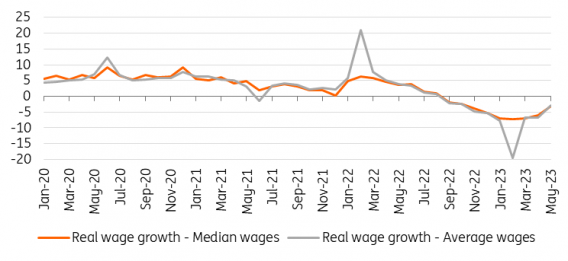

We expect a turnaround in real wages as early as September

Average wage growth remained strong in May, rising by 17.9% YoY on the back of higher bonus payments. However, after adjusting for inflation, real wages fell by 3% YoY, extending the streak of negative real wage growth to nine months. The good news is that we expect real wage growth to return to positive territory as early as September, in line with the strengthening of the disinflation process.

As for other labour metrics, the three-month unemployment rate remained at 3.9% in the April-June period, showing that the cost-of-living crisis is encouraging people to work. In addition, strong demand for seasonal workers pushed the participation rate to a record high in June. In this regard, even if the seasonal effects fade, we expect the unemployment rate to peak in the vicinity of 4%, as the labour market faces structural shortage problems.

Growth of real wages in Hungary (% YoY)

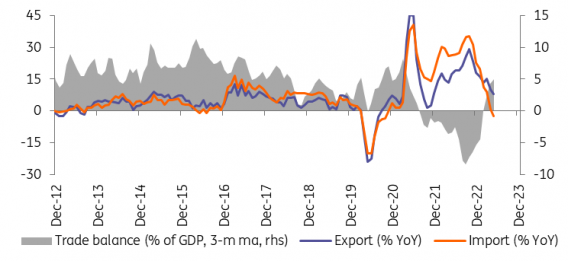

Import pressure eased by subdued domestic demand

The combination of high inflation and high interest rates is weighing heavily on domestic demand, reducing the need for imports. In addition, as the energy issue appears to be easing this year, the pressure on the trade balance from the import side is easing significantly. Conversely, the export side has huge growth potential due to new EV battery plants, while carmakers are still dealing with backlogs.

Taking all these factors into account, the staggering €1.1bn trade balance surplus in May hardly comes as a surprise. In our view, high-frequency data point to a balanced current account (CA) at the end of the year. However, a looming recession in the eurozone, coupled with a weaker-than-expected economic rebound in China, could significantly weaken the export outlook, and thus may limit the upside to the CA.

Trade balance (3-month moving average)

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](https://www.fxmag.com/media/cache/article_small_filter/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)