The collapse in domestic demand strengthens disinflation

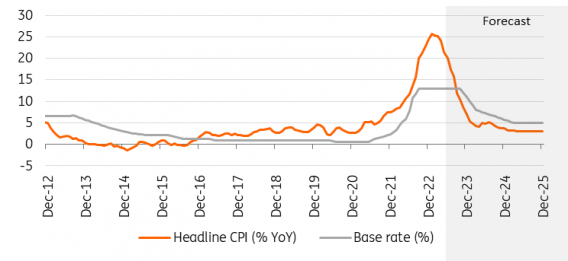

Headline inflation eased to 20.1% YoY in June, mainly driven by the 0.4% MoM decline in food prices. Within this, the fall in processed food prices was the main driver, hence the sharp 2ppt deceleration in core inflation to 20.8% YoY. In our view, the rapid deterioration in firms' pricing power is evident, and will only accelerate going forward as competition among retail outlets for households' overall shrinking disposable income intensifies.

Based on our high-frequency data collection, we expect disinflation to strengthen further going forward, driven mainly by food deflation. In this context, we expect average inflation to fall to single digits in the fourth quarter, while average inflation for the year as a whole is likely to be below, but close to 18%.

Inflation and policy rate

Rate cuts to continue in 100bp steps if market stability prevails

At the July meeting, monetary policy normalisation continued as the National Bank of Hungary (NBH) lowered the effective interest rate by a further 100bp to 15%. The central bank emphasised cautiousness, graduality and predictability, so we expect same-sized cuts into the September merger of base and effective rates.

After September, however, the NBH has several options to alter the interest rate complex. The central bank can either continue the easing cycle unabated in 100bp increments, setting the policy rate at 10% at the end of 2023. However, reducing the pace of cuts to 50bp seems to be another viable option, leaving the key rate at 11.5%.

In our view, the NBH will cut both repo and deposit rates by 100bp in October, leaving room for market rates to adjust lower, but will only cut the base rate by 100bp in November and December. We, therefore, expect the policy rate to end the year at 11%.

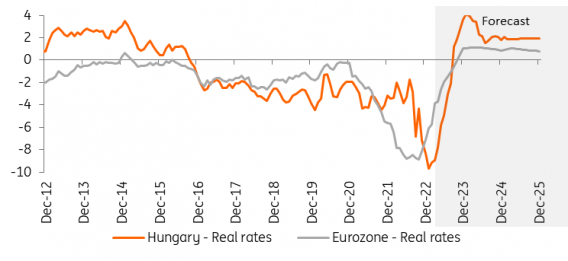

Real rates (%)

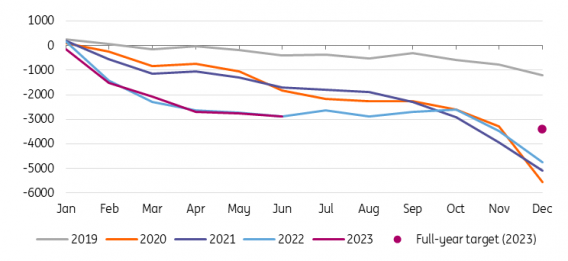

VAT receipts hit hard by fall in domestic demand

The Hungarian budget posted a deficit of HUF 132.7bn in June, bringing the year-to-date cash flow-based shortfall to 85% of the full-year target. The decline in domestic demand is weighing heavily on tax revenues. In this respect, VAT receipts in the first half of 2023 were only 2.2% higher than a year ago compared to the 24% average inflation during this period. Despite some ongoing adjustments (e.g. public investment cuts), we still see a slippage of 0.5-1% of GDP in this year's budget.

A recent interview with the Finance Minister revealed that a revision could come as early as September, which in our view could lead to additional adjustments plus a minor increase in the 2023 EDP deficit target. From a cash-flow perspective, the fate of the EU funds remains a key issue, with the clock ticking (90 days) at the European Commission's table, as the government officially submitted the self-review on horizontal enabler (judiciary) reforms on 18 July.

Budget performance (year-to-date, HUFbn)

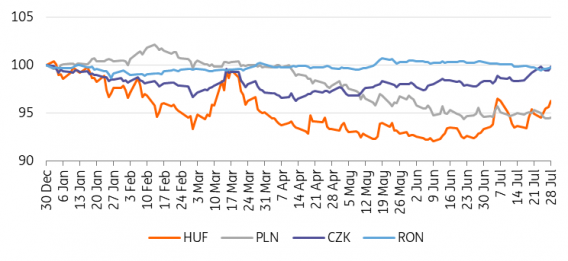

We still believe in a HUF turnaround

Although we heard what we thought we would from the National Bank of Hungary – a cautious cut with a commitment to remain patient – market players were ignorant of the hawkish message. The NBH’s assurance that the cutting cycle will not be accelerated did not result in a turnaround in EUR/HUF as we expected. However, our market view remains unchanged. In case of further forint weakening, we expect the central bank to hit the wire and repeat some hawkish statements, trying to push against HUF underperformance versus Central and Eastern European peers. Moreover, we see some improvement in conditions at the global level, too.

Last but not least, despite the whole EU fund issue being overly politicised, we still believe in a positive outcome before the year-end. Our ultimate argument would be that European politicians don’t want to bother with Hungarian issues when European Parliament elections are approaching (June 2024). On a local level, we think FX carry should continue to be the main positive driver for the HUF, supported by an improving current account, a record decline in gas prices, and despite cuts by a cautious central bank, overall pushing EUR/HUF closer to 370.

CEE FX performance vs EUR (30 December 2022 = 100%)

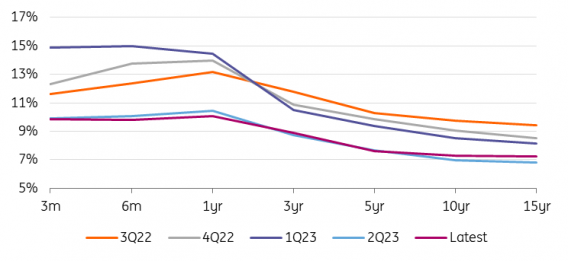

We continue to see further curve steepening

In the rates space, we found the IRS curve a bit steeper again after the last NBH meeting and a steeper and lower curve remains our main view for the coming months. 2s10s spread has moved roughly 100bp since May, the first rate cut, and we still see room for further normalisation of the IRS curve, which remains by far the most inverted in the CEE universe.

Market expectations for this year are more or less fair given that the September rate merge is a broad market consensus, however, NBH's next steps are unclear to the market, and we see the market underestimating further normalisation in the next year or two, opening the door for more curve steepening. On the other hand, the fall in core rates will slow the normalisation of the curve compared to previous months.

Hungarian sovereign yield curve

Hungarian government bonds (HGBs) eased in July and the rest of the region caught up with the swift rally. We therefore see current valuations of HGBs as more justifiable, which could attract new buyers. Despite the fiscal slippage risk, year-to-date issuance has reached 60% by our calculations, which we see as more than sufficient. Moreover, recent government measures supporting HGBs and the fastest disinflation in the region should be enough to sustain demand.

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](https://www.fxmag.com/media/cache/article_small_filter/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)