No surprises today as Bank Indonesia keeps policy rate unchanged

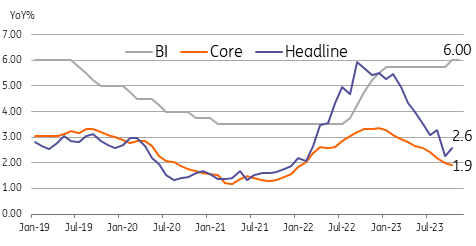

Indonesia's central bank has opted to keep the policy rate at 6%, in line with estimates.

BI opts to keep the policy rate at 6%

Bank Indonesia (BI) held fast today, retaining the policy rate at 6%, in line with expectations. With inflation still relatively subdued, Governor Perry Warjiyo opted to pause despite renewed pressure on the rupiah. Despite today’s hold, BI indicated it would step up currency stabilisation efforts to limit the impact of imported inflation.

BI may have opted to refrain from tightening further after 3Q GDP slipped below market expectations and below the 5% threshold after seven straight quarters.

The central bank expects 4Q GDP to be “strong” citing solid consumer confidence and PMI readings pointing to a manufacturing sector in expansion. Meanwhile, domestic liquidity conditions were deemed “ample” with loan growth expected to hit 9-11% this year despite recent policy tightening.

On the external balance, BI expects the current account balance to settle somewhere within -0.4% to 0.4% of GDP this year, with the trade surplus normalising after a record-wide reading last year.

BI decides to hold today

BI done with rate hikes?

After hiking policy rates unexpectedly in October, BI opted to keep rates untouched, possibly with growth needing an extra boost to close out the year. The question now is whether Bank Indonesia is done with its current rate hike cycle.

We believe the answer will once again hinge on currency stability, with BI keeping its focus on providing support for the IDR. In the meantime, it looks as if the central bank is content with stepping up intervention via the spot, DNDF and bond markets to ensure FX stability.

In the coming months, BI will likely be keeping an eye on the currency and imported inflation dynamics, with the central bank likely remaining open to additional tightening should the IDR come under substantial pressure.

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](https://www.fxmag.com/media/cache/article_small_filter/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)