Tightening financial conditions pose headwinds for risk asset BTC. Elevated options skew shows buying put-protection is currently expensive. A bearish cross has appeared for ETH.

Chart of the Week: Mind the BTC and Financial Conditions Gap

- BTC is first and foremost another risk asset currently, so look for its returns to be driven in large part by macro risk factors. Financial conditions have been tightening YTD on the back of rising energy prices, market corrections, and geopolitical risks.

- A gap has been forming between BTC and tightening U.S. financial conditions – does BTC have some more catching “down” to do?

- The Chicago Fed National Financial Conditions Index (NFCI) shows positive and negative values (from 1 to -1) for tighter and looser financial conditions, respectively. It tracks U.S. financial conditions in money markets, debt and equity markets, and the traditional and “shadow” banking systems. Indicators are grouped into risk (captures volatility and funding risk), credit (measures credit conditions for households and companies), and leverage (measures leverage of households and businesses).

Fund Flow Tracker

- Aggregated exchange balances of BTC and ETH have dipped, after the sharp rebound during peak fear surrounding the recent Terra stablecoin collapse.

- In the past week, aggregated exchanges saw net outflows of 19.8K and 234.0K for BTC and ETH respectively.

- BTC balance held on OTC desks dipped as well, following a sharp spike upwards during the week of the stablecoin drama. However, the uptrend from the lows established in March 2022 remains intact.

Derivatives Pulse

- Options implied volatilities (vol) for BTC have quietened down considerably after going parabolic 2 weeks ago. 1-week implied vol currently stands at 73.9%, compared to 83.0% a week ago.

- ETH implied vols have come down significantly as well, with 1-week implied vol currently at 82.0% compared to 96.5% last week.

- The options put-call ratio for BTC continues to climb, while ETH’s has dropped from its YTD peak in April. BTC’s put-call ratio has only started playing catch up in the last 2 weeks, signaling increased exposure hedging – however, since most people buy protection late, this is occurring when BTC has already fallen 36.2% YTD and 55.2% from its peak in November 2021.

- Premiums typically are high when insurance is needed most – buying BTC and ETH put protection is indeed currently expensive, as seen in the elevated options skew.

- BTC and ETH perpetual futures funding rates are mostly positive overall, despite a few flashes of red during the past week, potentially signalling tilt towards long positioning.

Technically Speaking

- A bearish cross has appeared for ETH, with the 50-day moving average crossing the 100-day moving average on the downside. The other occurrence this year was back in January, after which ETH declined 40.5% before consolidating into a base.

Read next: Altcoins: Ripple Crypto - What Is Ripple (XRP)? Price Of XRP | FXMAG.COM

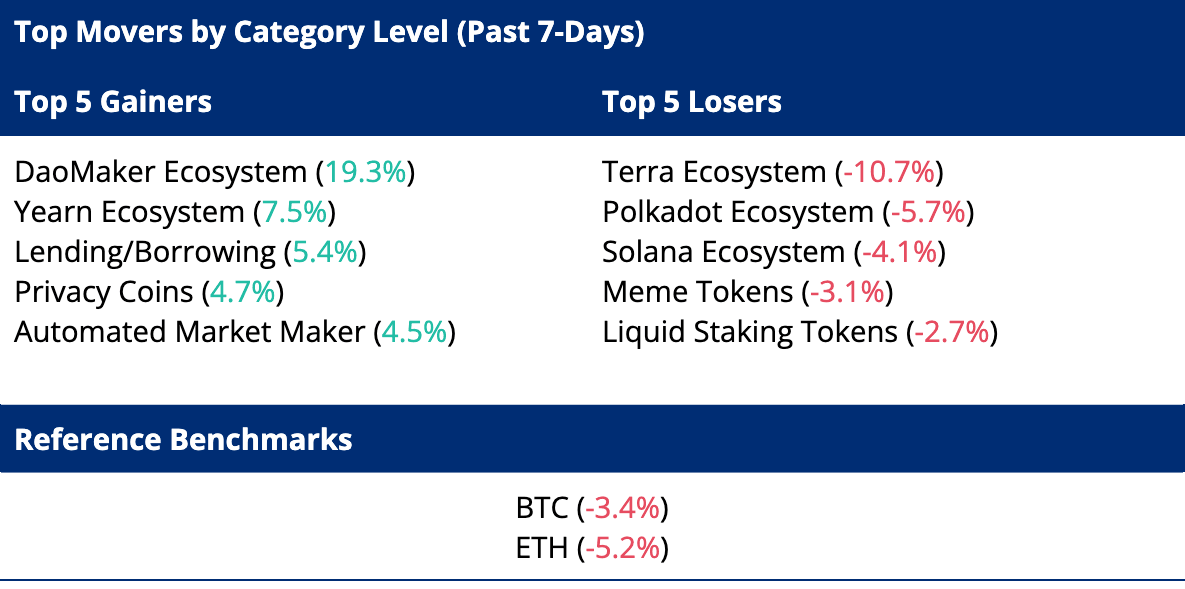

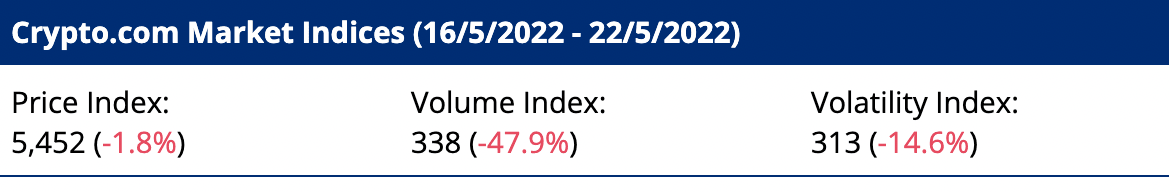

Price Movements

News Highlights

- USDT issuer Tether published a reserves report in a bid to boost transparency across backed assets. In the report, Tether reduced exposure to riskier assets and increased holdings in safe haven assets. This follows in the footsteps of stablecoin USDC issuer Circle’s reserves statement.

- Financial messaging network, Society for Worldwide Interbank Financial Telecommunication (SWIFT), is conducting tests for interoperable CBDCs across multiple domestic CBDC networks. The company previously conducted its first set of cross-border transactions in 2021.

- China has re-surfaced as the world’s second largest Bitcoin miner, despite the government’s ban in June 2021, according to a report from the Cambridge Centre for Alternative Finance.

Read next: Altcoins: Cardano (ADA) What Is It? - A Deeper Look Into Cardano (ADA) | FXMAG.COM

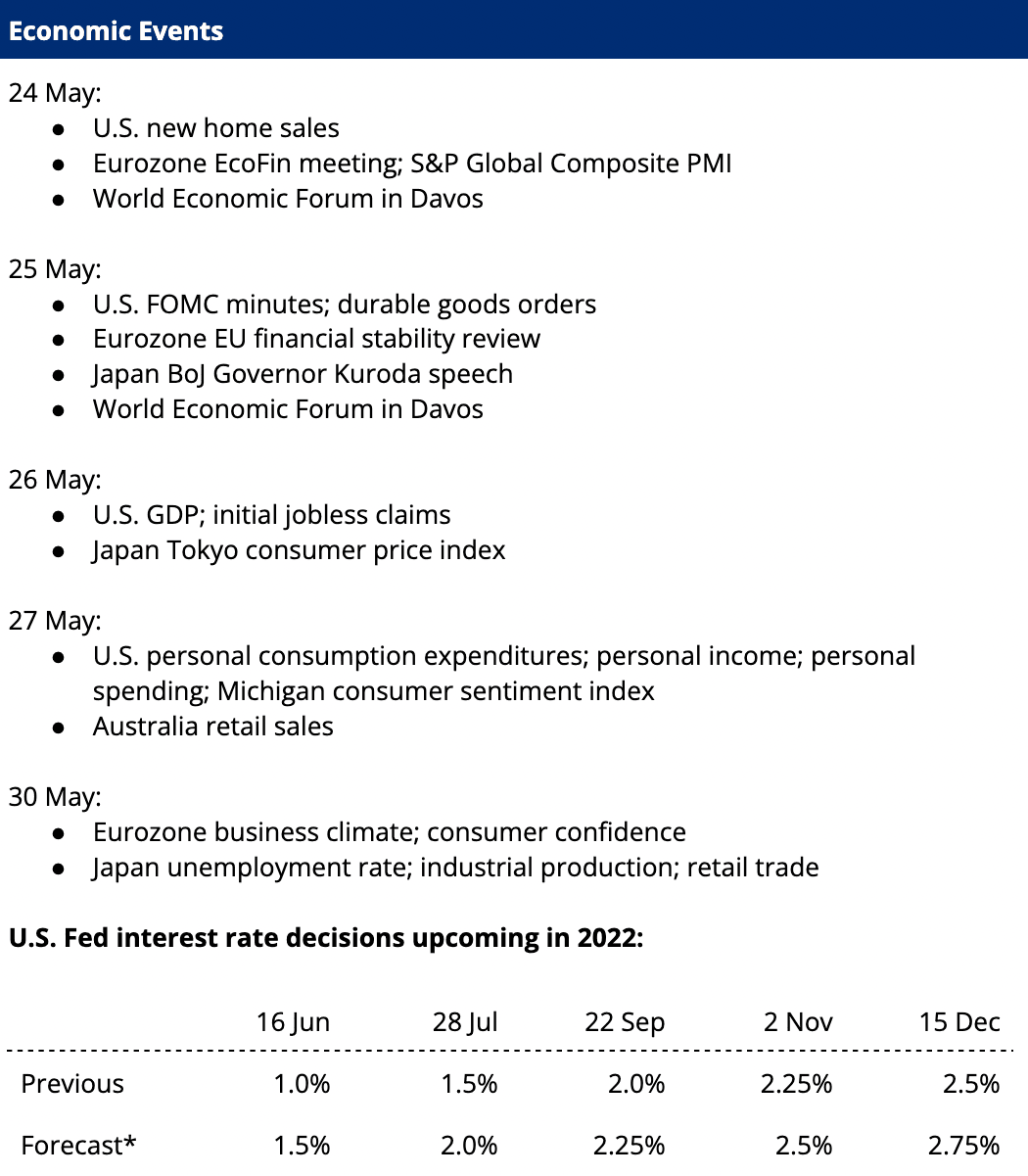

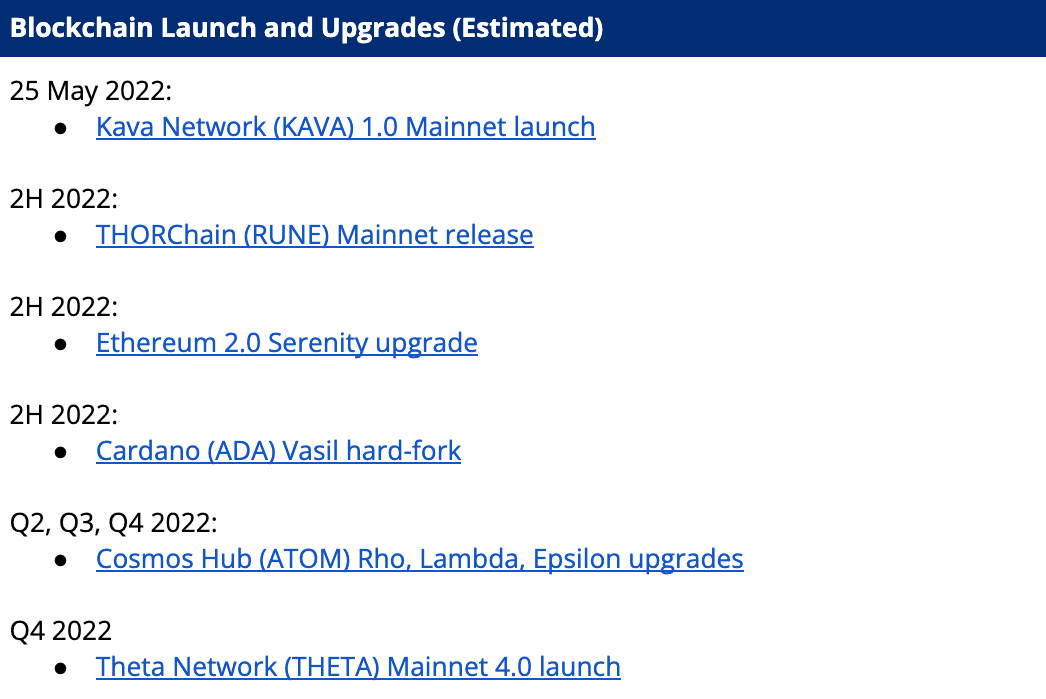

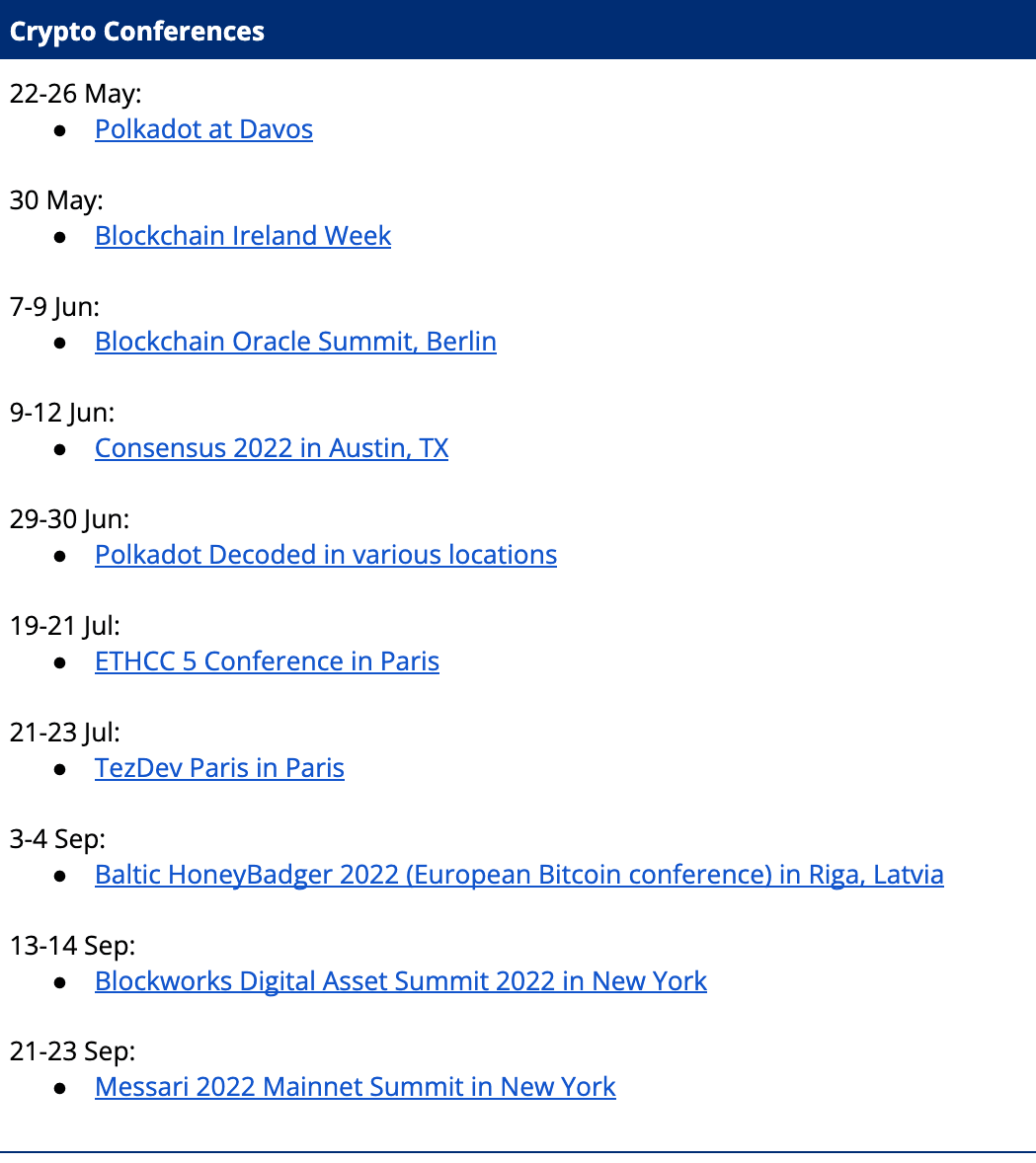

Catalyst Calendar

Disclaimer:

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing on this report are registered trademarks of their respective owners.

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](https://www.fxmag.com/media/cache/article_small_filter/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)