Rates Spark: Risk-off as a contributor

Firm US retail sales were enough to cause the risk-off theme to sustain itself. And should we morph to risk-on, market rates are likely to come under upward pressure. Damned if you do, damned if you don't for market rates, at least for now.

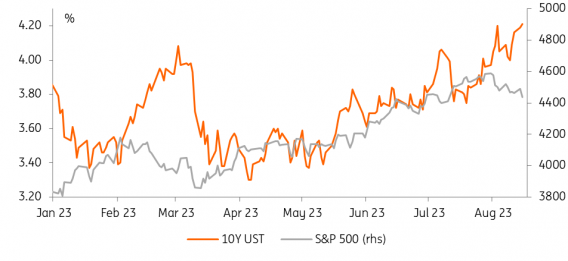

Risk-off is managing to temper room to the upside for yields just for now

The risk-off mode of late has become a central containment factor for US Treasuries. Had it not been for that, US Treasury yields would most likely have hit higher levels in the past few weeks. We also know there have been some solid inflows into Treasuries as a theme in the past month or so. There have also been ongoing and material inflows into money market funds. Against that backdrop there has been the build of a risk-off preference in both credit and equities. It’s not been severe, but it’s been there.

US data released on Tuesday was all over the place. Yes, there was manufacturing survey weakness, but that’s not new. We’ve had that practically for a year now, and still no macro-wide recession. There was also a fall back in the housing market index. This had shown a remarkable tendency to rise in recent months, but then snapped back to its long-run average at around 50 for August. The big surprise though was retail sales, which were strong for July. Too strong for the Fed to consider easing up just yet. Hence the risk-asset heaviness.

This week is shaping up as one that will likely see the US 10yr consolidate at comfortably over 4%. It’s been in the 4.15% to 4.20% area in the past couple of days, with mild breaks above. It may well consolidate a bit from here. Unlikely to break back below 4.1% for now, and more likely to trek up to the 4.25% area and then 4.3%. At that point the issue is whether it gets bought into enough to manifest in a rally, or whether it pushes on towards 4.5%. It’s still to early to look that far, but the odds currently remain in favour of the latter.

A drag on the latest leg higher in yields

FOMC minutes against the backdrop of brewing inflation expectations

Officials’ views on what the next steps of the Fed ought to be had been more diverse of late, with some seeing the need for more hikes, others stressing a lot had been done already. But given the resilience of the US economy, especially the consumer, and the brewing of longer-term market inflation expectations over recent weeks, the discussion of whether enough has been done to tackle inflation may gain more traction. Yesterday, it was the Fed’s Neel Kashkari who posed that question more explicitly.

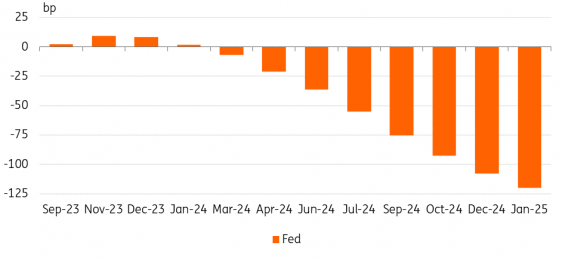

A pause in September still remains the base case also for markets, especially after the latest benign inflation print. Rather than pricing in hikes, the question now is more about how long that pause will last. Obviously all eyes are on the upcoming Jackson Hole symposium starting on 24 August for the next policy directives. Today, we will get the minutes of the July FOMC meeting, in which the Fed hiked by 25bp and retained a bias to do more. If that hawkish sentiment is reflected in the minutes it may well resonate with current market sentiment.

Markets price a Fed on hold, followed by cuts starting in the first half of 2024

Today's events and market view

Poor risk sentiment finally caught up with rates, but it also looked like investors were covering their short positions. Initially, yesterday's upside surprise in UK wage growth data set the bearish tone for rates, but dynamics switched after the strong US retail sales data. This morning's UK CPI figures surprised slighly to the upside again, but it appears the market's focus is shifting - with China risks top of mind and the recent rating agency warnings around US banks, this time from Fitch.

Ahead of this evening's FOMC minutes, markets will also have US housing starts as well as industrial production data to digest. In Europe, we will see 2Q GDP readings and also industrial production data.

In primary markets, the focus is on Germany’s €2.5bn 30Y bond auctions

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](https://www.fxmag.com/media/cache/article_small_filter/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)