Rates Spark: Slowly gearing up to the key events

Markets are gearing up to this week’s main events. It is not just about this Thursday’s ECB meeting, but also about crucial data in the US and UK ahead of next week’s respective central bank meetings. Front-loaded issuance is helping to keep rates elevated, but we also expect hawkish risks to make a bearish case for rates this week.

Front end themes developing in a bear-steepening environment

With central banks seen to be approachig their tightening cycle peaks it is only natural that the upcoming meetings are in the spotlight, kicking off with the ECB decison this Thursday. With regards to central bank communications both the ECB and the Fed are in the pre-meeting black-out periods but we did hear from the BoE’s most hawkish member Catherine Mann yesterday, who noted that it was best to err on the side of further tightening. With regards to the market pricing of the BoE decision outcome, we have seen a notable shift towards the sense that the end of the tightening cycle is nearing. The implied probability for a hike next week had slipped below 80% at the end of last week – late last month the market was still more than fully pricing a 25bp hike.

The main focus in the US this week is still on data however, with the August CPI release tomorrow. Our economist has flagged the risk of the month-on-month core inflation rate accelerating slightly. While that won’t move the needle for next week’s Fed decision, where a pause is widely anticipated, it would indicate hawkish risks to the broader Fed outlook. The market is attaching a 50% chance to another Fed hike by year-end.

Front loaded corporate issuance activity ahead of the events, especially in the US, is keeping upward pressure on rates. Markets will also have US Treasury supply in mind, where we saw a softer 3Y auction yesterday. The 10Y and 30Y reopenings follow today and tomorrow. It is a similar story in Europe, where we also saw the EU announcing a 7Y deal and – with greater market impact – the UK announcing a syndicated reopening of a 50Y Gilt which weighed on the long end of the curve.

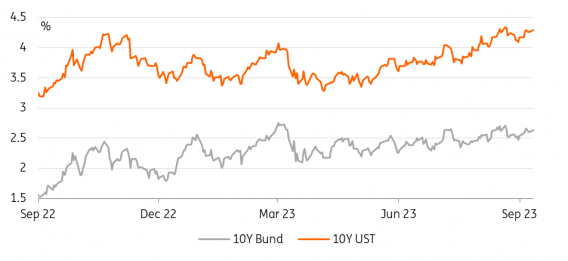

10Y yields are again approaching the upper end of recent ranges

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](https://www.fxmag.com/media/cache/article_small_filter/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)