Rates Spark: My home is my castle

After the Belgian success story of its one-year retail issue, Italy yesterday announced the launch of its second 'BTP Valore' retail bond for early October. The large volumes involved have knock-on effects on other marketable debt issuance and are a supporting factor for government bond spreads, especially now that the ECB QT debate could pick up.

A stable funding source for governments: households

Belgium has grabbed the headlines in recent days with a €22bn one-year retail issue. Beyond the implications for bank deposits, against which it was advertised as direct competition, the success of the sale also had implications for the country’s government bond and bills markets. The net funding via the bills market was reduced from a contribution of €2.8bn to a planned decline in the bills stock of €4.4bn. Long-term bond issuance (OLOs) was trimmed by €2.9bn to €42.1bn for the year.

Yesterday, Italy announced the launch of its second 'BTP Valore', a five-year instrument targeting retail savers. The first instalment launched in June attracted a total volume of €18bn. Such large sizes attract the attention of markets not just for their knock-on effects on issuance plans, but also as it sets the country on a more diversified and stable funding mix.

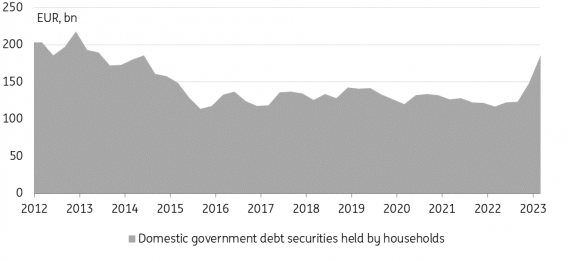

Historically, Italy has had a larger footprint in the domestic market, but it has specifically tapped into the retail segment to a greater degree with dedicated Futura and Valore issues on top of the BTP Italia. At the end of August, these three types of retail government bonds accounted for €122bn or 5.1% of Italy’s central government debt instruments. Prior to the pandemic, the level stood at €78bn or 3.9% at the end of 2019. But since late 2022, households have started to dip more into government debt, raising their investments from €123bn to €185bn over two quarters through the first quarter of 2023.

Italian households dipped into government debt again

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](https://www.fxmag.com/media/cache/article_small_filter/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)