Industrial Metals Monthly: China's stimulus in focus

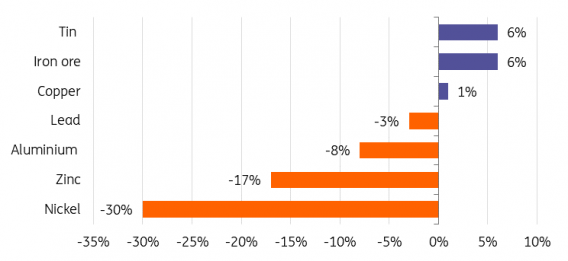

Our monthly report looks at the performance of iron ore, copper, aluminium and other industrial metals, as well as their outlook for the rest of the year. In this month's edition, we take a closer look at the recent impact of new stimulus measures introduced in China.

Metals markets assess China policy

China ramping up economic support

A mixed picture of China's economy has been painted by the latest releases of official PMI data. While the manufacturing index increased slightly to 49.7 – its third consecutive rise since the lows of 48.8 seen in May – it's still falling short of the 50-level mark associated with expansion.

The non-manufacturing series, which had reflected the bulk of the post-reopening recovery, fell further in August. At 51.0, the index was a little lower than the forecast figures of 51.2 but at least remains slightly above contraction territory.

Meanwhile, the Chinese government has moved forward with a series of stimulus measures designed to turn around the flagging economy and its ailing property sector, which accounts for more than a quarter of China’s economic activity. Included in these measures was the decision to cut down payments and lower rates on existing mortgages. The nationwide minimum down payment will be set at 20% for first-time buyers and 30% for second home buyers. Mortgage rate cuts will be negotiated between banks and customers, and both policies will go into effect on 25 September.

The introduction of these measures came after China’s home sales slumped in August. Sales by the country’s largest developers fell 34% from the previous year, according to China Real Estate Information Corp. It was the deepest drop seen in over a year. Further stimulus packages could also be introduced, which could boost the need for industrial metals. So far, Beijing has remained reluctant to back major stimulus that might be necessary to put a floor under falling home sales.

News of a surge in home sales in two of China’s biggest cities has offered an early sign that government efforts to cushion a record housing slowdown are helping. Existing home sales for Beijing and Shanghai doubled over the last weekend (2-4 September) from the previous one. Reports of property developer Country Garden avoiding default with last-minute interest payments also restored some additional confidence in China’s property sector.

The metals markets will now be watching how sustainable this pickup in interest is and how long it will last. China’s recovery is still uncertain, and metals are likely to see some continued volatility for a while – at least in the near term. For the remainder of this year, the key factor for the direction of metals prices will be whether China will be able to stabilise its property market. Until the market sees signs of a sustainable recovery and economic growth in China, we will struggle to see a long-term move higher for industrial metals.

Fed pause bets bolster sentiment

Sentiment in metals markets also received a boost after last week’s US jobs report that showed a steadily cooling labour market, offering the Federal Reserve room to pause rate hikes this month. Nonfarm payrolls increased 187,000 in August, while hourly earnings rose slightly less than the median economist forecast.

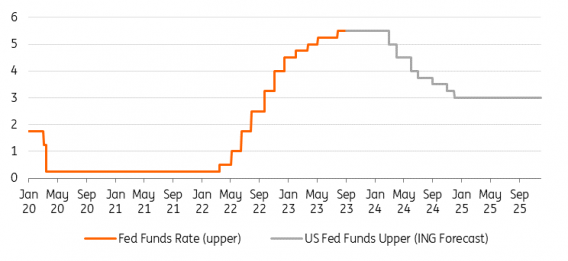

The central bank hiked rates by 25 basis points at its July meeting following the recent strength seen in economic data. At the Jackson Hole conference last month, Fed Chair Jerome Powell announced plans to keep policy restrictive until confidence that inflation is steadily moving down toward its target has been fully restored. Over the next few weeks, we'll be keeping a close eye on US data releases which could shed more light on what the Fed may do next.

Higher-for-longer interest rates will ultimately lead to a drop in metals prices

September appears set for a pause given recent encouraging signals on inflation and labour costs, but robust activity data means the door remains open for a further potential increase. Markets see a 50% chance of a final hike, while our US economist believes that rates have most likely peaked. US interest rates remaining higher for longer would lead to a stronger US dollar and weakening investor confidence, which in turn would translate to lower metals prices.

US rate cuts to start by the spring

Iron ore rises on China property aid

Iron ore prices held above the $100/t mark in August despite China’s worsening property crisis, which in typical years makes up about 40% of demand.

Iron ore has managed to stay above $100/t for most of 2023

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](https://www.fxmag.com/media/cache/article_small_filter/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)