Gold gains after data fuels hopes of a Fed pause

Gold prices are moving higher following the latest batch of softer-than-expected US economic data, which has caused investors to trim bets on a Federal Reserve hike next month.

US economic data in focus

Ten-year Treasury yields have continued to decline after recently hitting levels last seen in 2007, after US data releases this week signalled that the US economy is cooling, easing pressure on the Federal Reserve to continue raising rates.

US inflation in July was in line with expectations, second-quarter economic growth was revised lower, and private payrolls increased less than expected in August. This followed data released earlier this week that showed job openings have fallen to their lowest level since early 2021. Focus will now turn to the headline US labour market report which is due later today.

The latest data releases have lowered expectations that the Fed will raise interest rates this year. The central bank hiked rates by 25 basis points at its July meeting as economic data was strong.

Both higher rates and yields are typically negative for non-interest-bearing gold.

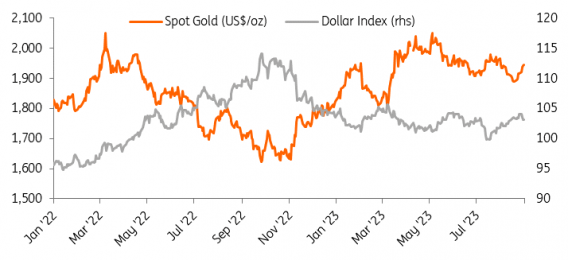

Gold holds above $1,900/oz

Gold has been unable to break the $2,000 level since mid-May

Federal Reserve Chair Jerome Powell said at the Jackson Hole conference last week that the Fed plans to keep policy restrictive until it is confident that inflation is steadily moving down toward its target. We will need to keep a close eye on US data releases in the coming weeks, which could shed more light on what the Fed may do.

We believe gold will remain volatile in the near term given the implications of the uncertainty of persistent inflation on the US economy, and its trajectory will be influenced by US economic data in the coming weeks. We believe the threat of further action from the Fed will continue to keep the lid on gold prices for now.

ETFs continue to see outflows

The rebound in gold prices has failed to draw buying interest from investors in exchange-traded funds or the Comex futures market. Gold ETF positioning, typically a strong driver of price direction, has been falling with holdings tumbling for a third month in August.

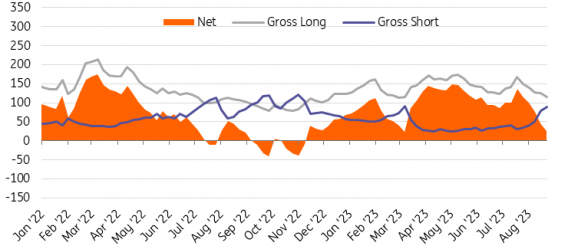

Hedge funds turn more bearish on gold

Hedge funds and other large speculators have also reduced their net long positions in gold, according to the latest CFTC data for the week ending 22 August. Net long positions in gold fell by 44.75% to 79.9 tonnes, equivalent to 25,695 contracts. Open interest decreased to 581,386 contracts from 598,932 contracts.

Outright long positions declined by 7.33% or 28.5 tonnes, to 360.1 tonnes or 115,766 contracts. Short positions rose by 14.89% to 280.2 tonnes or 90,071 contracts

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](https://www.fxmag.com/media/cache/article_small_filter/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)