|

There's little sign that UK wage growth has reached a peak, and the jobs market looks reasonably healthy. A 25bp rate hike at the March meeting seems likely

|

| The UK job market looks health |

|

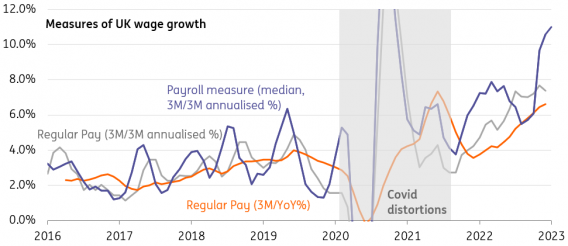

UK wage growth has come in higher than expected in the latest jobs report, and this will be a concern for the Bank of England’s hawks. The headline year-on-year change in regular pay (measured as a three-month moving average) came in at 6.7%, up from 6.5% and above expectations. Admittedly, the fact this beat consensus was mainly down to revisions, and in level terms, December's pay level was only marginally above November's.

But these numbers are volatile month-to-month, and that’s why the Bank of England favours looking at the annualised change over the past three months, relative to the prior three months. This measure is running over 7% and has been for a few months now. The alternative, payroll-based measure is running at 11% now on the same annualised basis.

|

|

UK wage growth doesn't seem to have peaked

| 3M/3M annualised change = the annualised change over the past three-months, relative to the prior three-months |

Source: Macrobond, ING calculations |

|

|

|

Read next: Poland’s President Andrzej Duda Said The Decision To Send Fighter Jets To Ukraine Was “Not Easy To Take”| FXMAG.COM

In short, there's little sign that wage growth is slowing, as some recent surveys have suggested. And the rest of the report shows the jobs market in reasonable health too.

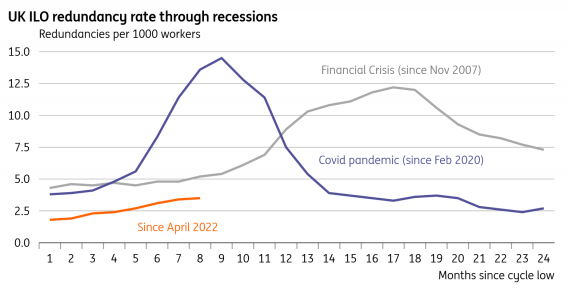

The unemployment rate remains well below 4%, close to all-time lows. Redundancy rates have been gradually rising, though only to pre-Covid levels from an unusually low base.

Encouragingly, the number of people neither employed nor actively seeking a role (economically inactive) has inched lower recently, though mainly due to lower student numbers rather than a decline in levels of long-term sickness. The number of EU workers in the UK also inched higher in the latest quarterly data, though remain 6% below pre-Covid levels. Higher inactivity levels and a net outflow of EU workers through the pandemic have been key contributing factors to skill shortages.

|

|

UK redundancy levels are rising but remain low by historical standards

|

|

Today’s data is one of a few key releases the Bank of England will be watching ahead of its March meeting, and so far the dial is pointing towards a 25bp rate hike. But with the BoE putting greater emphasis on the lagged impact of past tightening, and with inflation likely to show signs of improvement by spring, we suspect a March rate hike will be the last.

Read more on what data the BoE is watching to decide its next move

|

|

| Read this article on THINK |

Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](https://www.fxmag.com/media/cache/article_small_filter/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)