Next week's UK data will be important for the March rate decision. We expect headline inflation to edge lower due to the 4% drop in petrol/diesel prices, and core inflation should ease too on the back of lower demand. US January activity data is going to be strong throughout given the warmer weather and we expect core inflation to rise to 0.4% month-on-month

US: Not yet the start of a new upward trend

Next week will be an interesting one with US inflation, retail sales and industrial production all released. The first thing to say is that January activity data is going to be strong throughout. The contrast between the weather in mid-late December, where it was incredibly cold, versus a very mild January couldn’t be more stark. This means there will be delayed consumption plus better weather means more people out and about, which in all likelihood will lift January spending. We already know auto sales were very strong and that will lift retail sales mightily on its own.

The shock January employment jump also implies robust demand. Manufacturing, mining and construction may also look better given warmer temperatures make it easier to work and will lift output. I wouldn't class this as the start of a new upward trend though - more noise in what is generally a softening trend given business confidence is on a par with where we were during the Global Financial Crisis all those years ago. Note too, February has experienced a return to colder temperatures which could lead the correction back to more normal patterns. Nonetheless, with the Fed minded to keep hiking to ensure inflation comes down, it makes the likelihood of a May rate hike in addition to a March hike look more plausible.

Inflation could also boost the case for a May rate hike. Rising energy costs through January will lift the headline rate, but used car prices will boost the core, too. The jump in auto sales saw dealers raise their profit margins with car auction prices jumping 2.5%, according to Mannheim data. Given the high weighting of used vehicles within the basket of goods and services used to calculate CPI, this could add 0.15pp to the MoM rate on its own. Shelter, which accounts for a third of the overall inflation basket, is also likely to remain firm given the time house prices and then new rental agreements take to show up in the data. A 0.4% MoM core CPI print (or possibly even 0.5%) would give the Fed near-term ammunition to argue for a May rate hike. Nonetheless, we think that these two components (shelter and cars) will contribute to inflation slowing sharply from mid-second quarter, with weakening corporate pricing power also contributing to getting inflation down to 2% by year-end.

UK: data to help determine whether Bank of England hikes rates in March

The Bank of England has entertained the possibility that February’s 50bp rate hike might have been the last. In practice, we think we’ll get one more 25bp rate hike in March, though next week’s data will be important. The key words here are “inflation persistence”, which is what BOE officials have said they’re monitoring (read more here on what we think this means). Here’s what we expect over the next week:

- Jobs/wages: Wage growth has shown little-to-no sign of easing, at least in the official numbers. Quarter-on-quarter annualised changes in weekly regular pay have been eclipsing 7% recently, so we’ll be looking for any signs that this is slowing. The latest Bank of England Decision Maker survey, which we know officials pay close attention to, has hinted wage growth might have peaked.

- Inflation: Headline CPI should edge lower on a near-4% fall in petrol/diesel prices in January. Core inflation should ease too, though less dramatically. We’re seeing ‘core goods’ inflation come off quite rapidly as demand fades and supply chains improve – effectively a mirror image of what helped drive inflation higher during the pandemic. But the BoE will be watching ‘core services’ inflation most closely, given that it’s less volatile and tends to experience more persistent trends than goods categories. We expect this measure to edge higher, though the recent fall in gas prices suggests the peak could be near. Energy prices have been a commonly cited reason among corporates for raising prices over recent months.

- Retail sales: Real-terms spending has fallen in 12 out of the last 14 months, and we don’t think January was an exception. If so, it would point to a modest fall in GDP through the first quarter.

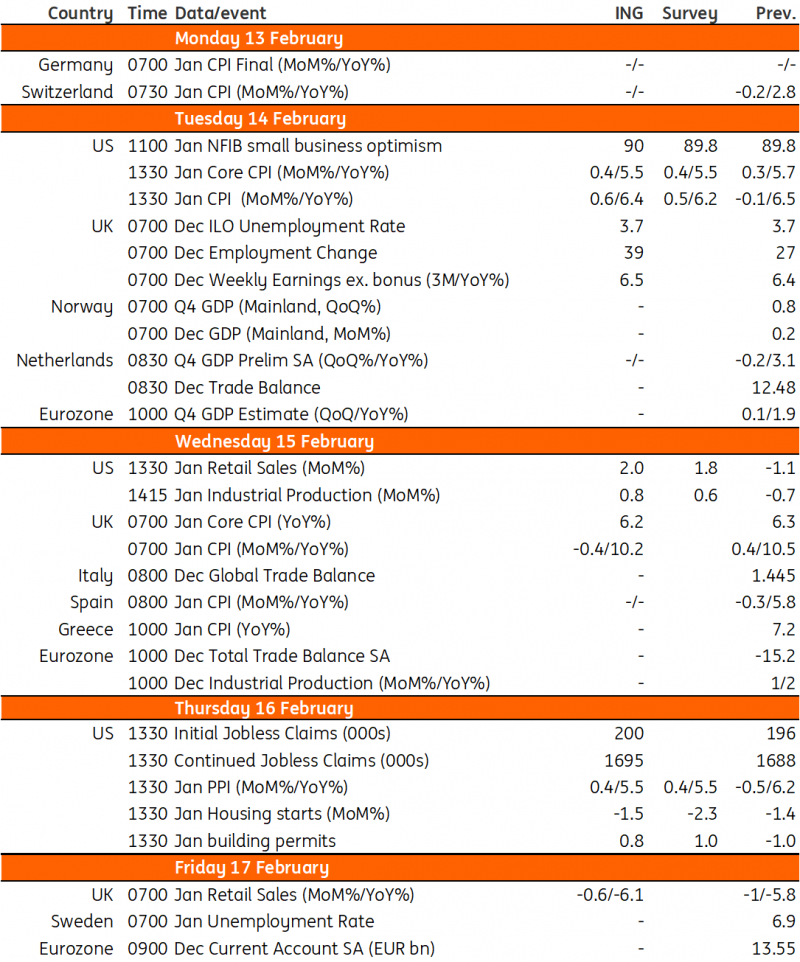

Key events in developed markets next week

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](https://www.fxmag.com/media/cache/article_small_filter/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)