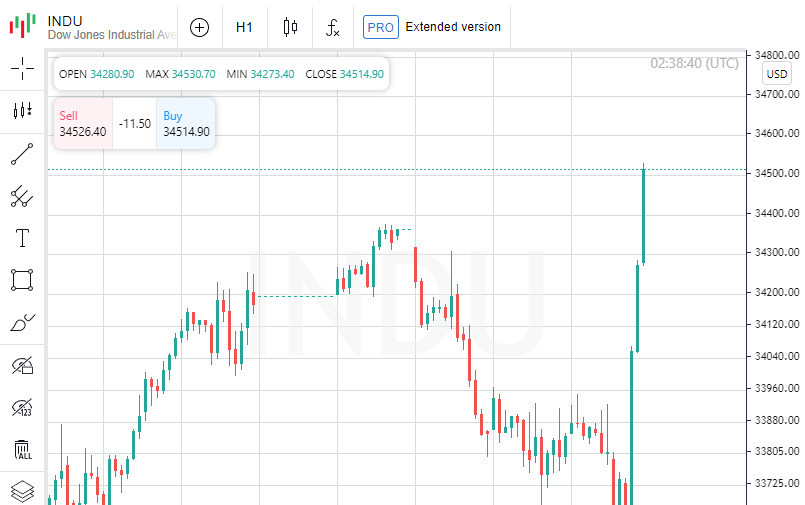

At the close of the New York Stock Exchange, the Dow Jones rose 2.18% to a 6-month high, the S&P 500 rose 3.09% and the NASDAQ Composite index rose 4.41%.

Dow Jones

The leading gainers among the components of the Dow Jones index today were shares of Microsoft Corporation, which gained 14.81 points (6.16%) to close at 255.14. Salesforce Inc rose 8.57 points or 5.65% to close at 160.25. Apple Inc rose 4.86% or 6.86 points to close at 148.03.

The least gainers were Walmart Inc, which shed 0.55 points or 0.36% to end the session at 152.42. 3M Company rose 0.13% or 0.16 points to close at 125.97, while Caterpillar Inc rose 0.55% or 1.29 points to close at 236.41.

S&P 500

Leading gainers among the S&P 500 index components in today's trading were Estee Lauder Companies Inc (NYSE:EL), which rose 9.70% to 235.79, Netflix Inc, which gained 8.75% to close at 305.53, as well as shares of Hewlett Packard Enterprise Co, which rose 8.57% to close the session at 16.79.

The least gainers were NetApp Inc, which shed 5.82% to close at 67.61. Shares of Charles River Laboratories shed 4.56% to end the session at 228.57. Hormel Foods Corporation fell 2.47% to 47.00.

NASDAQ

The top performers on the NASDAQ Composite Index today were Biophytis, which rose 92.03% to hit 0.67, Corbus Pharmaceuticals Holding, which gained 60.08% to close at 0.19, and Biodesix Inc, which rose 47.06% to end the session at 2.00.

The least gainers were Aeglea Bio Therapeutics Inc, which shed 65.98% to close at 0.41. Shares of CN Energy Group Inc lost 44.93% and ended the session at 0.82. Pacifico Acquisition Corp lost 42.81% to 5.41.

Number

On the New York Stock Exchange, the number of securities that rose in price (2686) exceeded the number of those that closed in the red (442), while quotes of 105 shares remained virtually unchanged. On the NASDAQ stock exchange, 2,913 companies rose in price, 872 fell, and 199 remained at the level of the previous close.

The CBOE Volatility Index, which is based on S&P 500 options trading, fell 5.98% to 20.58.

Gold

Gold futures for February delivery added 1.99% or 34.75 to hit $1.00 a troy ounce. In other commodities, WTI crude for January delivery rose 2.86%, or 2.24, to $80.44 a barrel. Futures for Brent crude for February delivery rose 2.93%, or 2.47, to $86.72 a barrel.

Forex

Meanwhile, in the Forex market, EUR/USD rose 0.76% to hit 1.04, while USD/JPY fell 0.44% to hit 138.07.

Futures on the USD index fell 0.75% to 105.96.

Relevance up to 03:00 2022-12-02 UTC+1 Company does not offer investment advice and the analysis performed does not guarantee results.

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](https://www.fxmag.com/media/cache/article_small_filter/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)