Relevance up to 19:00 UTC+2 Company does not offer investment advice and the analysis performed does not guarantee results. The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

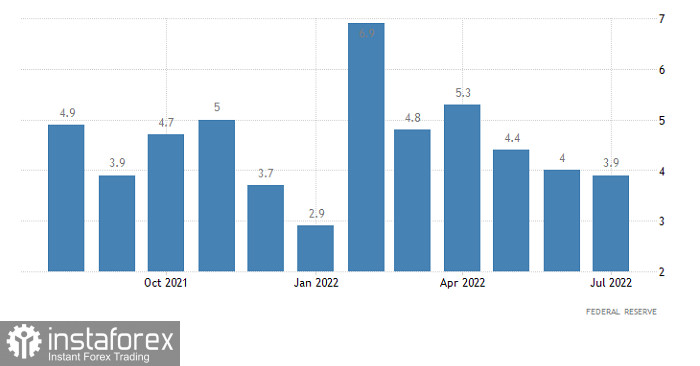

It was expected that the growth rate of industrial production in the United States will slow down from 4.2% to 4.0%, which should have been the reason for a slight rebound. In principle, everything happened just like that, and the pound strengthened its positions a bit. Only now the data turned out to be slightly worse than forecasts. Previous results were revised down to 4.0%. And the growth rates themselves slowed down to 3.9%.

Industrial production (United States):

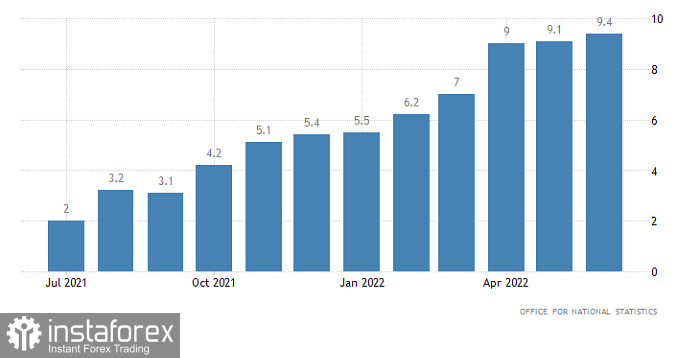

Today, the pound will continue to grow, already due to data on inflation in the UK, which should accelerate from 9.4% to 9.9%. Such a strong rise in inflation will convince market participants that the Bank of England will not only continue to raise interest rates, but will do so more actively. This alone is enough for the steady growth of the British currency.

Inflation (UK):

At the same time, the pound's growth will obviously be of a protracted nature, as it will be supported by data on retail sales in the United States. And their growth rates should slow down from 8.4% to 8.1%. So we are talking about a decrease in consumer activity, which is the main locomotive of the American economy.

Retail Sales (United States):

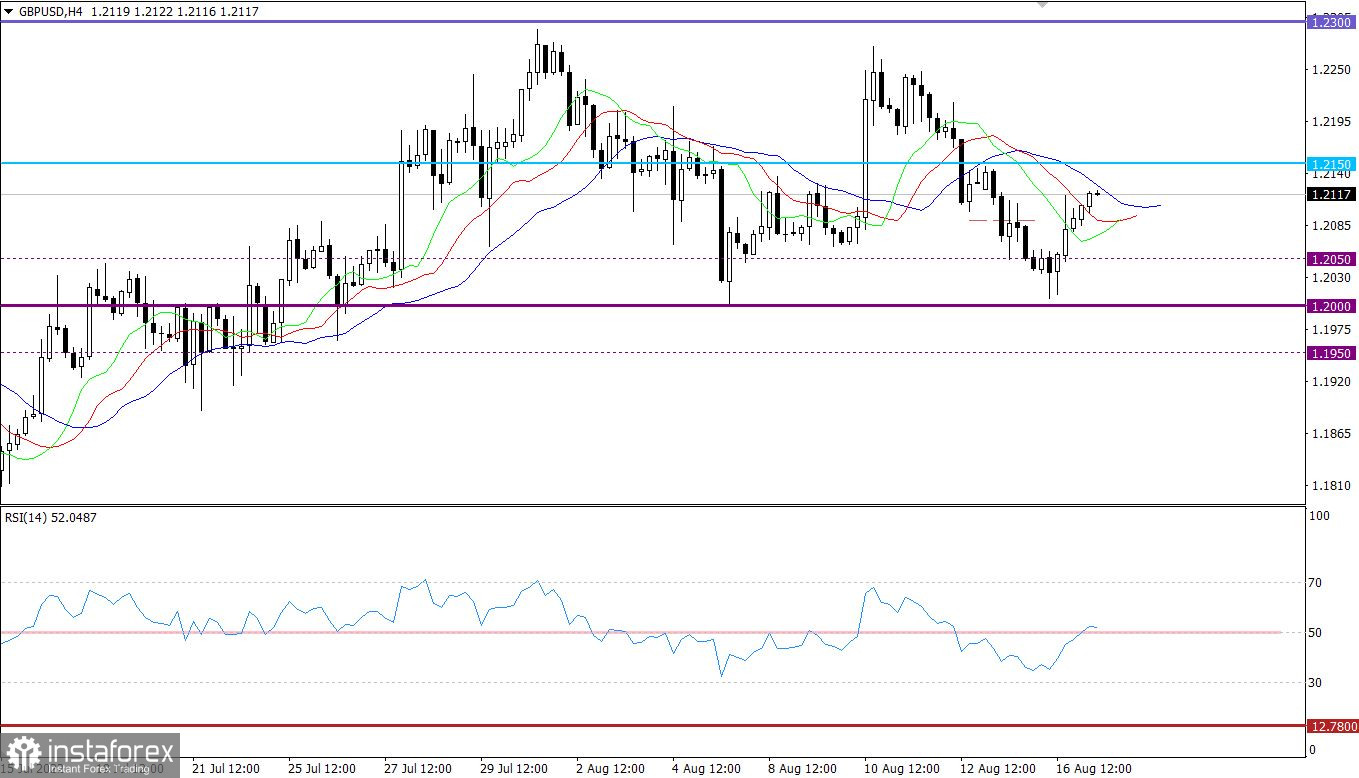

The GBPUSD currency pair rebounded from the psychological level of 1.2000 with surgical precision. As a result, there was an increase in the volume of long positions, which caused the pound to strengthen by about 100 points.

The technical instrument RSI H4 crossed the 50 middle line upwards at the time of the rollback, which indicates a slowdown in the downward cycle from the resistance level of 1.2300.

Alligator H4 has an intersection between the green and red MA moving lines. In this case, this crossover corresponds to a slowdown in the downward cycle. While Alligator D1 has a lot of crossovers, which indicates a slowdown in the medium-term downward trend.

Expectations and prospects

The rollback stage may well slow down the move around 1.2120/1.2150. In this case, there will be a gradual increase in the volume of short positions, returning the quote to the psychological level of 1.2000.

The scenario of prolongation of the current rollback will be considered if the price stays above the value of 1.2160 in a four-hour period.

Comprehensive indicator analysis in the short-term and intraday periods has a buy signal due to the rollback stage. Indicators in the medium term have a variable signal, due to a slowdown in the downward trend.

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](https://www.fxmag.com/media/cache/article_small_filter/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)