IMF calls for a uniform crypto regulatory framework globally. Germany is the ‘most crypto-friendly country,’ says a recent report. Oman plans to allow issuance of real estate tokens.

APR 21, 2022

Key Takeaways

-

On Tuesday, The International Monetary Fund (IMF) released its quarterly Global Financial Stability Report, in which it encouraged global policymakers to implement a uniform regulatory framework for crypto.

-

Germany surpassed Singapore as the most crypto-friendly country in the world in a recent report from Coincub that ranks 46 countries. The report looks into countries’ crypto acceptance based on a number of factors, including ICO status, fraud prevalence, and general availability.

-

Oman’s virtual asset regulatory framework is set to include real estate tokenization, which will allow the issuance of virtual assets such as real estate tokens for the first time. The country aims to open up real estate opportunities for local and foreign investors.

Highlights

-

Europe’s largest electronics retailer to install bitcoin ATMs

-

Major crypto exchanges in India disable fiat deposits amid regulatory uncertainty

-

El Salvador’s bid for bitcoin bonds sinking as IMF deal ‘practically dead’

-

BoJ official says digital yen won’t be used to achieve negative interest rate

-

Texas, Alabama securities regulators block sales of ‘metaverse’ casino NFTs

-

Tencent nearing launch of Digital Yuan wallet-WeChat integration

-

New Virginia law allows state-chartered banks to custody crypto

-

EU crypto firms protest ‘alarming’ anti-money laundering laws

-

Regulatory arm of UAE Financial Centre releases DeFi discussion paper

-

Alleged Hydra administrator Dmitry Pavlov reportedly arrested in Russia

-

Bitcoin miners to face tougher penalties in Iran if they operate illegally

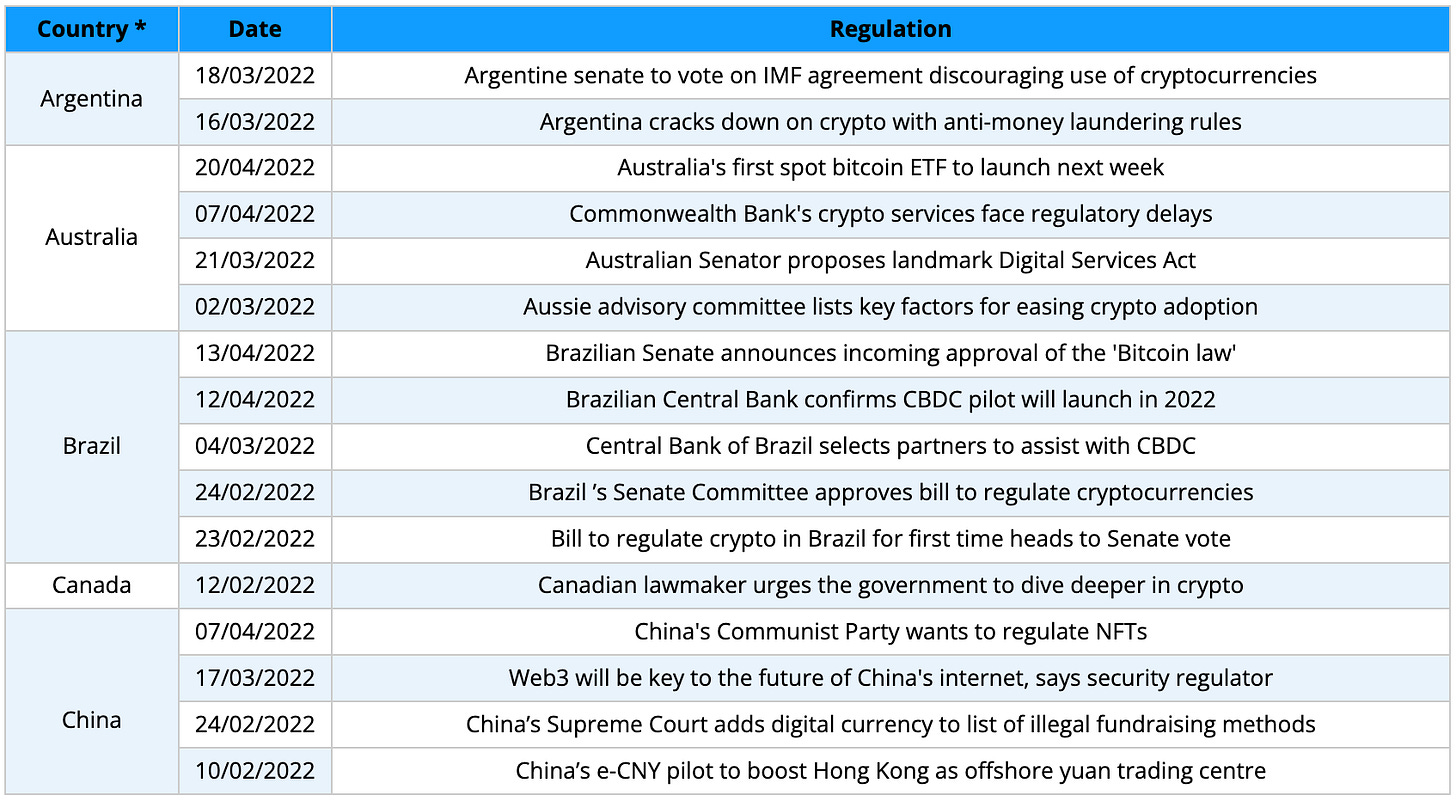

G20’s Latest Crypto Policies

* G20 countries here do not include all but only selected member states.

* G20 countries here do not include all but only selected member states.

* G20 countries here do not include all but only selected member states.

* G20 countries here do not include all but only selected member states.

G20’s Regulatory Heatmap

Data as of April 2022; Source: WhiteSight

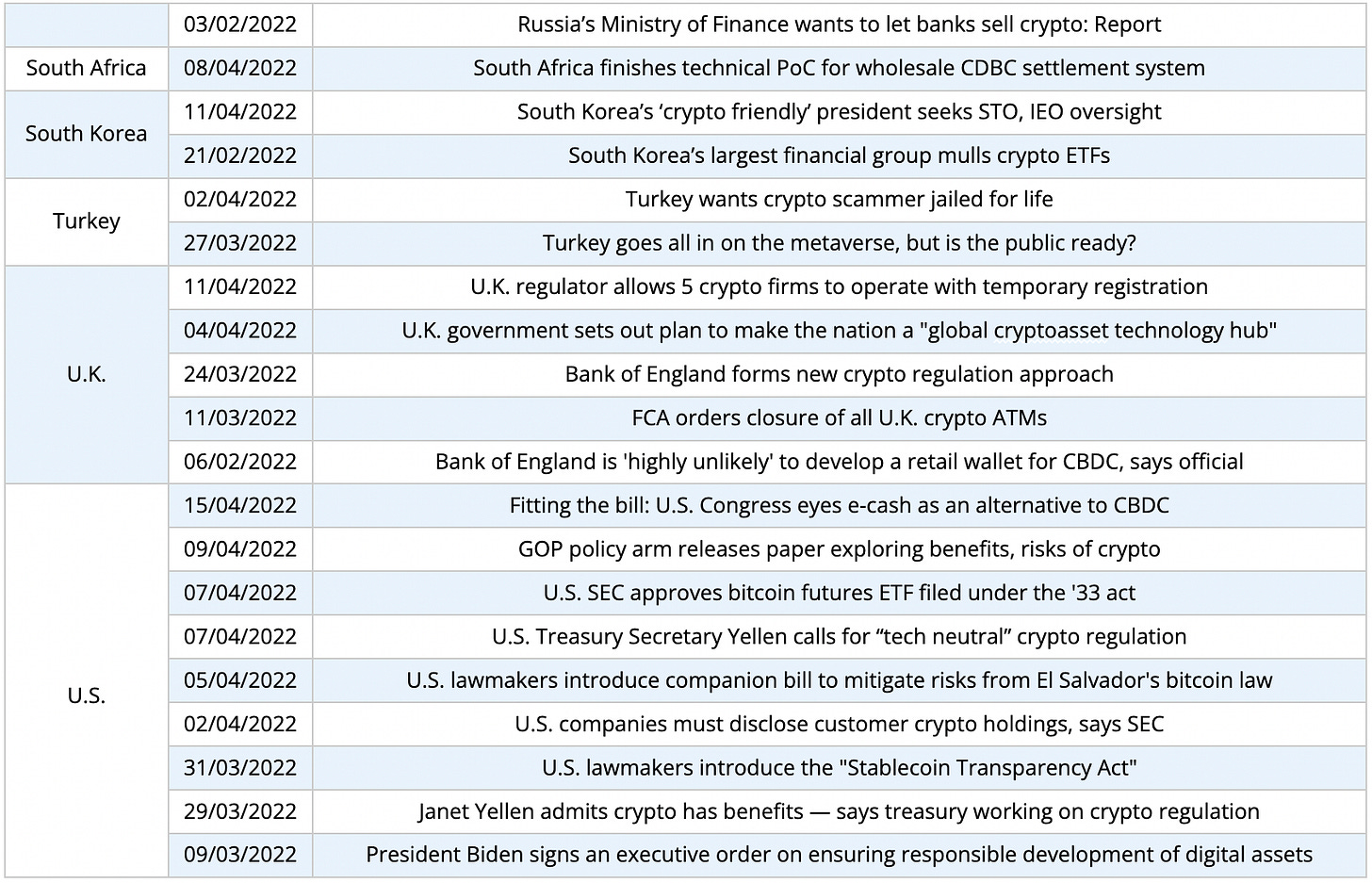

G20’s Crypto Taxation

* G20 countries here do not include all EU members, but selected ones only

To view a full picture of G20’s cryptocurrency policies, please subscribe to Crypto.com Research’s Weekly Regulatory Update on Substack.Disclaimer: The information provided in this newsletter is for general informational purposes only. It is not intended to constitute legal or other professional advice in any way whatsoever. All information in the newsletter is provided in good faith. However, we have not verified the information independently and make no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability or completeness of any information in the newsletter. Views and opinions expressed do not necessarily reflect the view of Crypto.com or any of its officials. The information provided herein should not be relied on or treated as a substitute for professional advice.

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](https://www.fxmag.com/media/cache/article_small_filter/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)