Relevance up to 11:00 2022-06-11 UTC+2 Company does not offer investment advice and the analysis performed does not guarantee results. The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The summer of 2022 becomes the key for the future of the main altcoin Ethereum. On the one hand, the asset is approaching a historical event and the transition to Proof-of-Stake. On the other hand, the asset is trading near the dangerous level of $1.8k, and risks updating the local bottom near the level of $1.3k. This development is indicated by both fundamental factors and technical metrics.

The coin largely echoes the movement of Bitcoin and is approaching a defining moment. The asset is completing the formation of a "wedge" figure on the daily chart. This indicates an increase in volatility, as well as a likely momentum out of the narrowing range. The technical indicators point to an ongoing period of consolidation. However, the RSI and the stochastic oscillator are gradually dropping to the lower border of the bullish zone, which indicates a slight dominance of sellers.

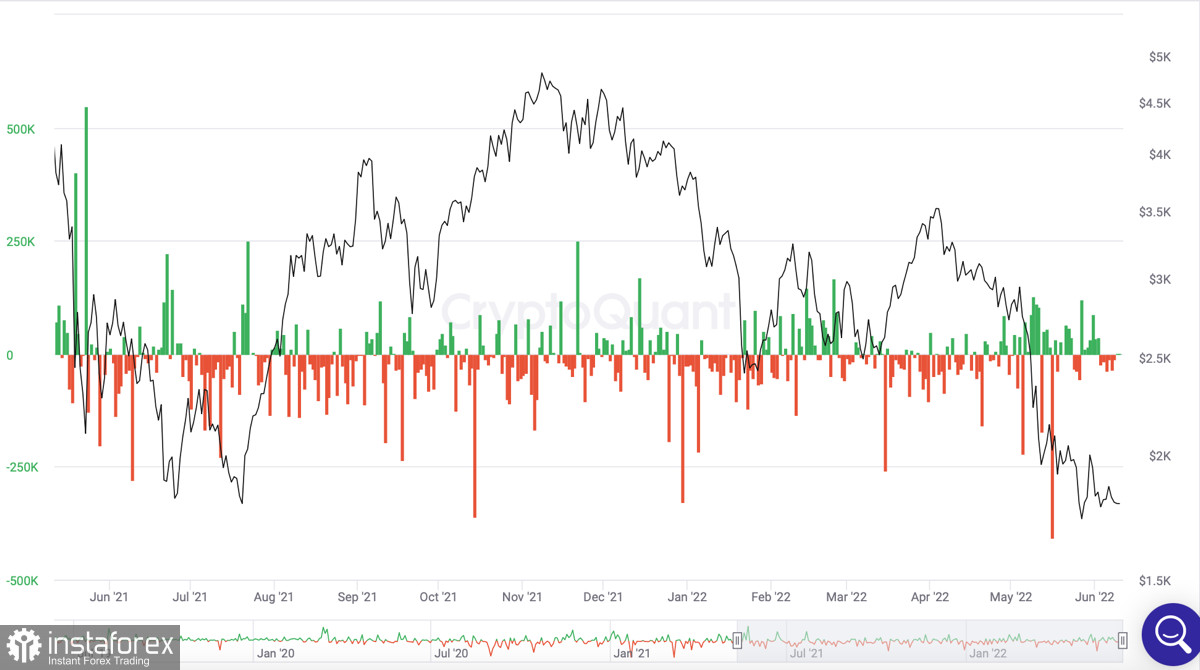

In addition, there is a constant influx of ETH coins to exchanges, which is a negative factor in anticipation of the transition to PoS. At the same time, it should be noted that there are impulsive withdrawals of coins from cryptocurrency exchanges, but they are local in nature and do not occur on an ongoing basis. In many ways, this situation was formed due to the growing level of Bitcoin dominance. Ether failed to become a full-fledged deflationary asset, including due to the transition to Proof-of-Stake.

The Ethereum team has already migrated the Ropsten testnet to the PoS consensus algorithm. The first transactions have already been included in the testnet based on the new algorithm. The merge did not go smoothly, and the developers noticed problems with the proposal of new blocks by the validators. The team is currently working on a solution to this problem. In the long term, as the ETH network migrates to PoS, Ethereum's influence on the crypto market should increase. However, in the current environment, investors are not very enthusiastic about everything that happens, and there are two reasons for this.

Both of them are directly related to the bear market and its consequences. The total cost of funds in DeFi applications has decreased by 55% since the beginning of 2022. This indicates a low level of liquidity, and many projects have to adjust in order to survive. Transactions on the ETH network have also dropped to a minimum, as decentralized applications are the main source of transactions on the main altcoin network. A bear market will significantly "cleanse" this market, which will negatively affect the Ethereum ecosystem and the capitalization of the coin.

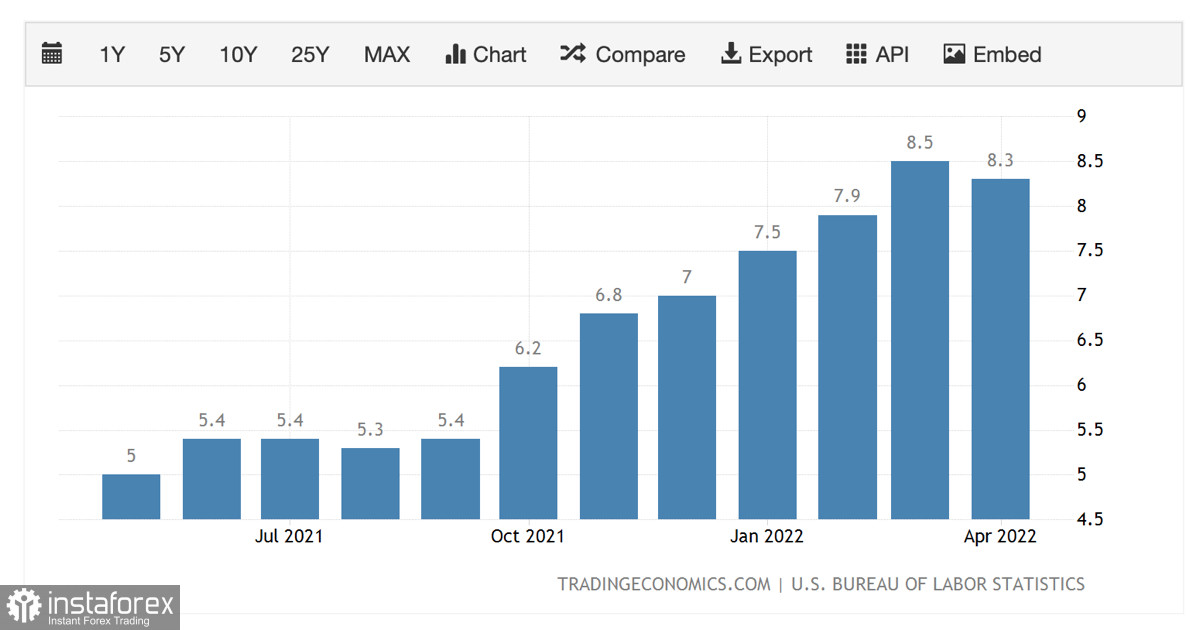

The second reason is the current macroeconomic situation. The main altcoin is not an important tool in the current environment, when the main goal of investors is capital protection and related investments. CoinShares notes that more and more VCs are opting for Bitcoin-based products due to high inflation rates. Similar forecasts are given in the central bank of the EU and the USA. In the current conditions, ETH completely loses the competition to Bitcoin.

In the current situation, the further movement of the ETH price will largely depend on Bitcoin. The main digital asset increased its dominance level to a six-month high, due to which the correlation of the altcoin with BTC increased significantly.

And if Bitcoin makes a downward breakdown of its own triangle, then there is every reason to believe that the ether will follow a new local bottom, which runs in the $1.3k–$1.4k area.

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)

![Warsaw Stock Exchange: Brand24 (B24) - 1Q23 financial results Turbulent Q2'23 Results for [Company Name]: Strong Exports Offset Domestic Challenges](https://www.fxmag.com/media/cache/article_small_filter/uploads/articles/2022-FXMAG-COM/GPWA/gpw-s-analytical-coverage-support-programme-wse-2-6311cd4191809-2022-09-02-11-30-41-63175bda84812-2022-09-06-16-40-26.png)